October has provided the much-needed kickstart to Bitcoin and Ethereum’s price rallies. The two assets notably created local highs over the past two days.

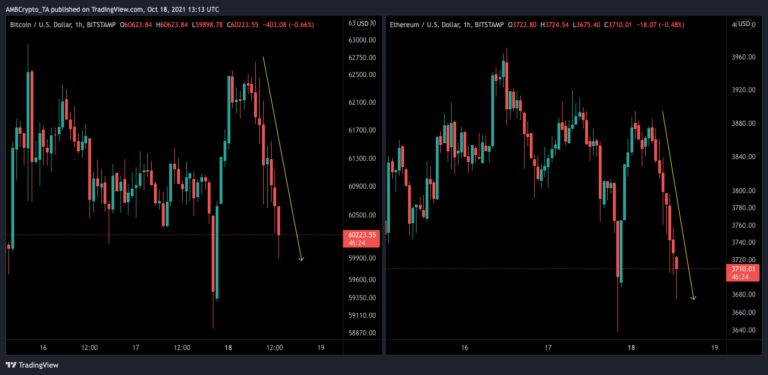

At the time of writing, however, Bitcoin was trading at the brink of $60k, while Ethereum was seen exchanging hands at $3.7k. In fact, the price of the two large cap coins seemed to be heading further south, indicating insufficient momentum in their respective markets.

Whales to the rescue?

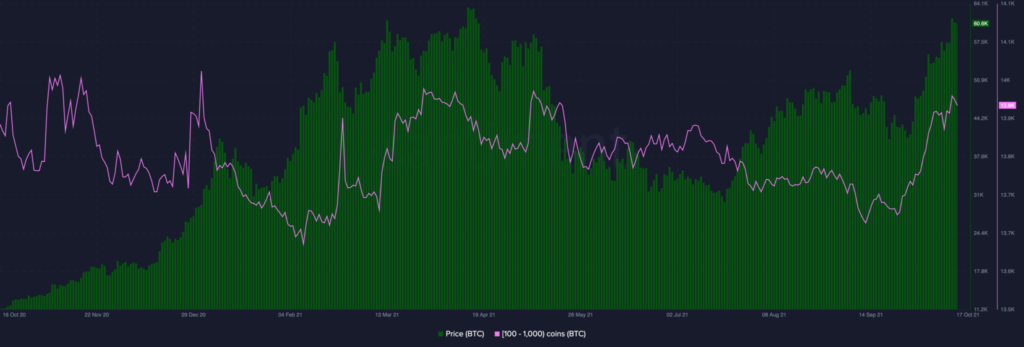

Major Bitcoin rallies in the past have been led by whales, and looks like the same would happen this time around too. Consider This – The number of Bitcoin addresses holding 100 to 1k BTC has grown to over 250 in the past five weeks alone. This equates to a cumulative slope of 2%.

Given the large amount of coins held, these addresses are usually considered to be a proxy of whale addresses. From the chart attached above, it can be clearly seen that a majority of whales resisted the previous market correction. Conversely, only a minority of large HODLers got rid of their coins.

Also, the 2% increase in the number of addresses has come at a faster pace compared to other periods in the recent past, which is a pretty good sign.

Additionally, as per CryptoQuant’s data, the relative size of the top 10 inflows to the total inflows for all exchanges has been declining since the last week of September. Whenever this number decreases, it indicates the whale selling pressure is declining.

On the other hand, as far as Ethereum is concerned, the number of addresses HODLing 100-1k ETH tokens has remained stagnant in the same 5-week time window.

That said, it’s also worth noting that the current number of addresses is quite reminiscent of May’s numbers, just as Bitcoin’s current numbers are in line with April’s. Whales have seldom aided Ethereum during uptrend phases in the recent past. Thus, the current unattractive figures do not pose a major problem.

Further, the exchange reserve numbers for both Bitcoin and Ethereum were seen revolving quite close to their all time lows at press time. So, to a large extent, it can be said that the new Bitcoin whales have already started their buying spree.

If the same continues, they might be able to reverse the trend on the short-term price chart. Ethereum, on the other hand, is expected to rely more on the participation of retailers to achieve the same feat.

In all, whale actions would prove to be more handy for Bitcoin than Ethereum.