At the time of composing, Bitcoin has actually smashed its method through the $60,000 resistance and appears all set to handle new highs. The first cryptocurrency by market cap records a 11.6% and 4.2% profit in the weekly and daily charts, respectively.

Pseudonym expert Pentoshi anticipates Bitcoin to gone into uncharted area in the future. As he pointed out, BTC’s price was capable of breaking out of its macro low high by forming a new trend.

As seen listed below, Bitcoin has actually produced a crucial assistance at the $50,000 levels with a 2 possible targets for Q4, 2021. The first located at $70,000 and the second at $85,000.

Bitcoin Gets Stronger As The Bulls Take Over

Data supplied by expert William Clemente in a report by Blockware Intelligence paints a bullish photo for Bitcoin. Less than 1% of BTC’s supply has been move above current levels.

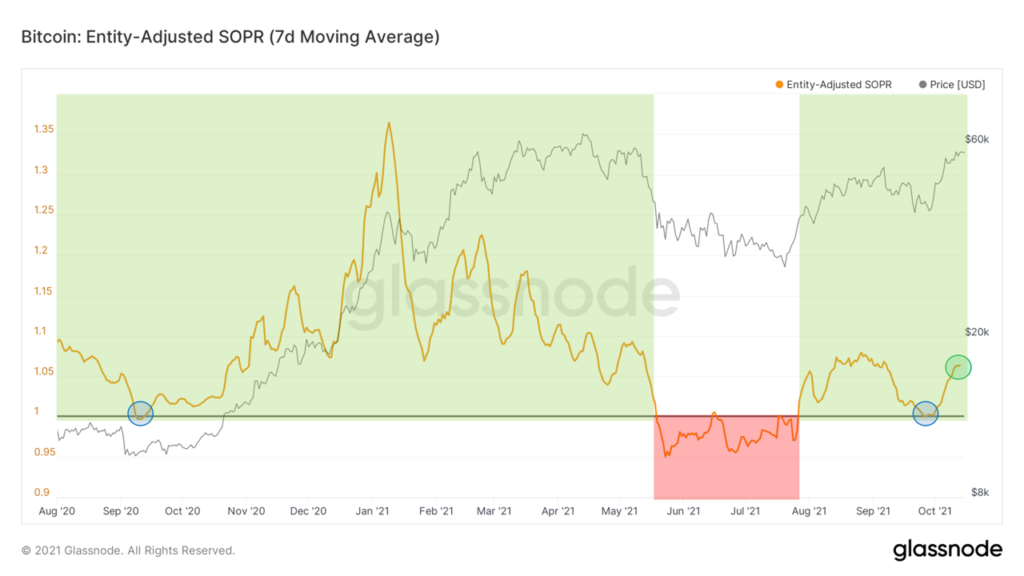

Therefore, the report declares there is “very little resistance or overhead supply to the upside”. The Bitcoin Entity-Adjusted Spent Output Profit Ratio (SPOR), a metric used to measure realized profit and loss for holders, sits well above 1.

As seen listed below, the last time this metric stood above 1 or greater was throughout April 2021 when Bitcoin was trading in its all-time high of $64,500.

There is some significant movement in the derivatives sector with the potential approval of a BTC Exchange Traded Fund (ETF) in the U.S. As reported by NewsBTC, this possibility is among the factor the marketplace has actually turned bullish.

The report expects that the BTC ETF approval to create new opportunities for institutional investors to enter the crypto market, suggesting fresh capital coming in, to take a “non-directional position in the Bitcoin market”.

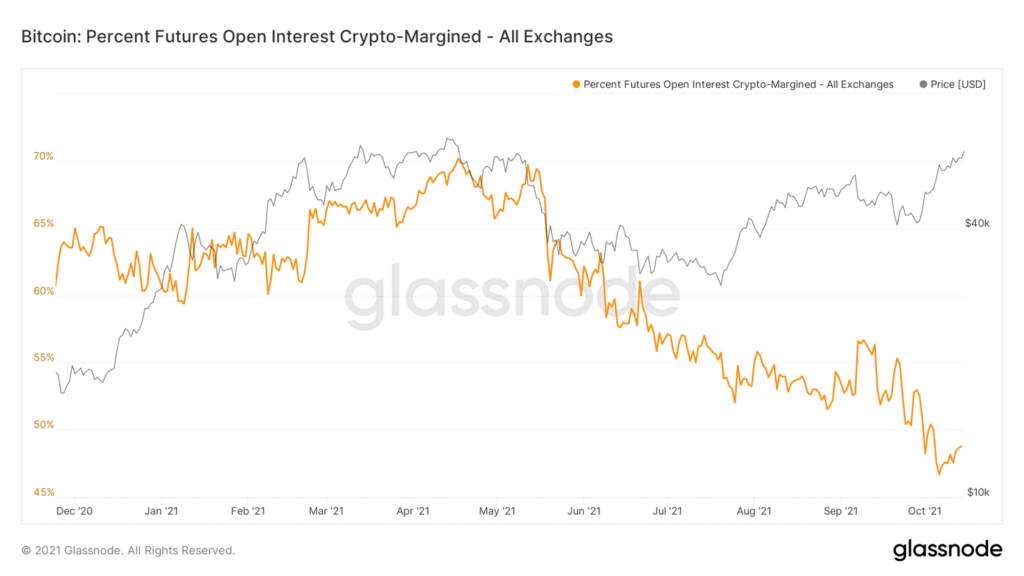

Thus, organizations will have the ability to benefit from the arbitrage produced in between the area and futures market. In addition, the Futures Annualized Rolling Basis indicates more upside pressure, as the report said:

This implies less convexity to the drawback and shorts are most likely to be squeezed as they no longer have an unintended hedge by means of their security. I suspect that this will reverse once breaking all time highs but we’ll keep an eye on it.

Bitcoin Whales Drive The Trend

On-chain activity has actually followed the bullish momentum in Bitcoin with an increased in big deals and trading volume over the previous 30-days. A quick look at explorer mempool.space shows a rise in transactions fees over the past 24 hours.

However, as the expert stated, whales are controling the marketplace as recommended by the absence of increase in google searches connected to cryptocurrencies and on-chain metrics, the report stated:

(…) we’ve actually seen the 100-1K cohort offset their selling by over 1,000 BTC in that time period. Overall, conclusion is that big purchasers have actually undoubtedly been active in the market