Cryptocurrencies are immensely popular right now. However, this wasn’t always the case. In fact, a survey conducted earlier this year found that about 84% of American adults either aren’t interested in or haven’t heard of digital assets.

At the time, participants mainly thought of it as a “speculative” asset class, one bound to fade in the coming year. Well, fast forward to September 2021 and there has been a paradigm shift in outlook.

“Pay me in crypto!”

Research and survey firm Skynova recently published a survey to highlight the aforementioned shift in perspectives. The same included more than 1,000 active professionals, including 797 employees and 205 executives. It was conducted to look into how Americans perceived Bitcoin & altcoins for workplace compensation.

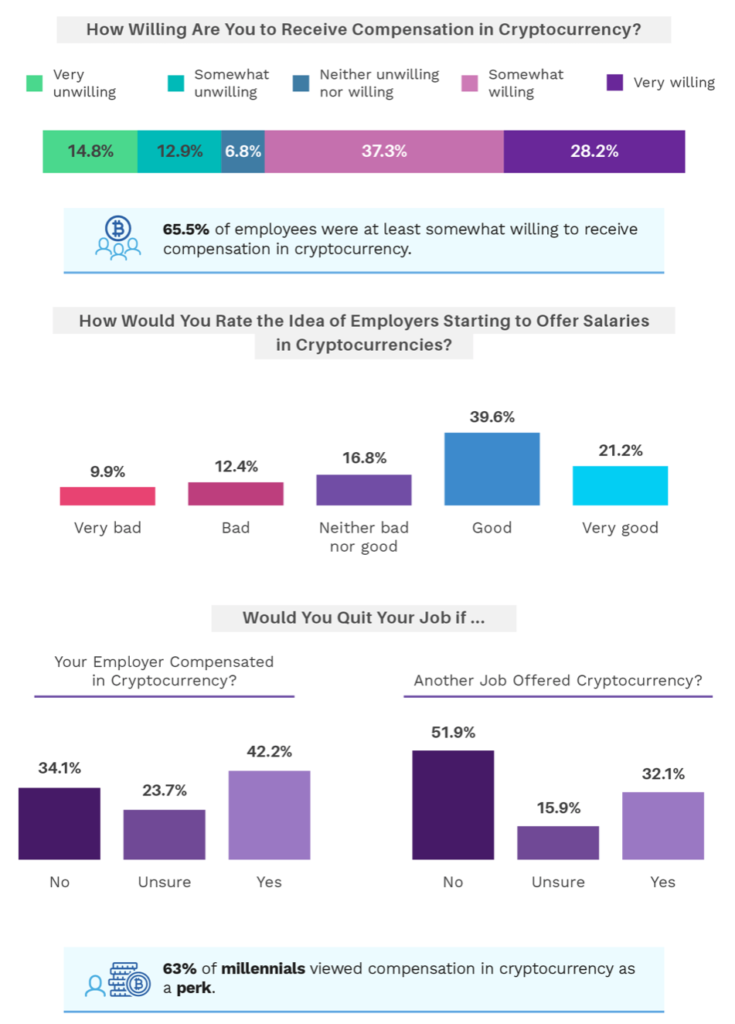

65.5% of those polled said they would be at least somewhat willing to receive compensation in cryptocurrencies, with just over 28% even ranking as “very willing”. Meanwhile, around 63% of millennials view compensation in crypto as a perk.

However, 9.9% are totally against the idea of their employers starting to offer crypto salaries.

In another segment, almost a third of the respondents said that they would quit their current job to pursue another that offered compensation in crypto. On the flip side, 42.2% said they would quit if their current employer started doing so.

Looking into the specifics

When questioned on which crypto they would like to see on their paychecks, a majority of the respondents (74.3%) voted for Bitcoin, followed by Ethereum (32.9%), and Dogecoin (26.5%).

However, around 12% answered “None”.

What’s driving this growing inclination to be paid in crypto though? Well, 45.5% of those who answered yes think crypto is the future of money. Other motivations include the potential for financial gains (41.3%) and the diversification of income (38.8%).

Crypto-clearing also has some drawbacks. While responding in the negative, respondents cited reasons such as market volatility (55.3%), potential for financial loss (50.2%) and limited acceptance (44%).

In addition to this, more than 200 of the respondents were managers, often in charge of hiring and compensation decisions. The report added,

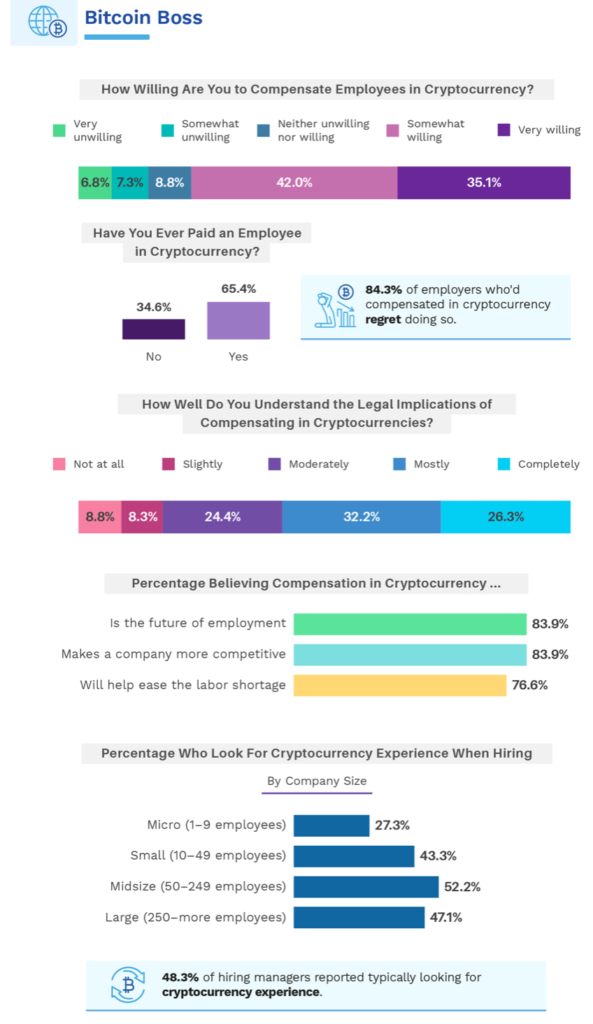

“Managers were actually more likely to be very willing to pay employees in crypto than employees were to receive it. This is in spite of the fact that managers who have already paid employees in Bitcoins ultimately paid 45% more, on average, than if the payment had been in USD and in spite of the fact that only 26.3% of managers said they fully understood the legal implications of compensating employees this way.”

From the aforementioned data points, it’s pretty clear that the outlook for cryptocurrency has changed dramatically. It has gone from simply a ‘speculative’ tool to serious discussions about compensations and asset classes.