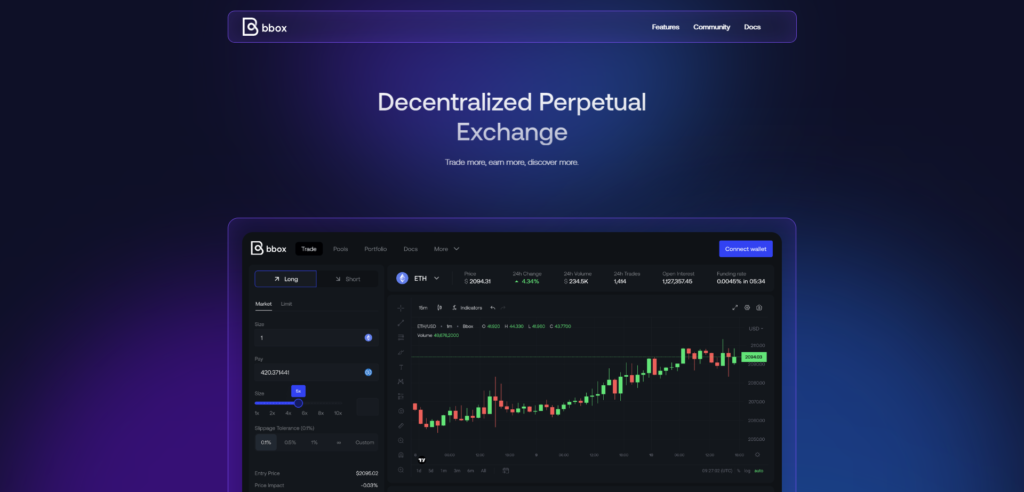

With the help of new funding, BBO Exchange plans to increase its market share in the decentralised derivatives trading industry. In particular, BBOX’s innovative solutions are expected to improve trading instruments for futures and contracts in terms of user-friendliness and capital efficiency.

BBO exchange (BBOX) secures $2.7 million in funding

The BBO Exchange team announced today, January 30, 2024, that its pre-funded investment round has concluded. $2.7 million in total was raised from a number of very respectable venture capitalists. Top-tier early-stage venture capital funds The round was co-led by Arrington Capital and Hashed.

Aulis Venture, Formless Capital, Press Start Capital, One Piece Labs, Arcane Group, Consensys, CMS Holdings, Flow Traders, Mask Network, Laser Digital (Nomura Group), Vessel Capital, Draper Dragon, and Mask Network were among the other prestigious venture capital firms that contributed to the round.

Expert angel investors, such as Keone Hon and Hongbo Tang, supported the startup’s funding efforts as well.

With its distinct approach to decentralised derivatives trading, BBOX is well-positioned to improve the DeFi field. Oracle Extractable Value was initially used by a perpetual DEX in its liquidation process, and the platform has created a novel auction mechanism that takes use of the natural lag in Oracle price updates.

Former high frequency trader Ray, the creator of BBOX, shared his thoughts on the team’s goals and the most recent fundraising round:

Our end objective is to establish a platform where users may trade anything, earn from everything, and do both really well. We intend to supply the infrastructure and liquidity layer for derivative trading to the whole DeFi ecosystem. This funding shows how investors believe we can offer something new and interesting to the DeFi derivatives market, and it also demonstrates our vision.

The signal-driven, multiasset dynamic distribution of the platform In addition, AMM gives limited partners the ability to match its price ranges to those of other assets, mimicking the tactics of aggressive market makers with the convenience of passive liquidity provision.

Private testnet kicking off on Linea’s zkEVM

The BBOX private testnet is now open for signup, and the company is now developing its signal-driven AMM on Linea, a zkEVM layer-2 network for scaling Ethereum dApps.

Notably, Consensys, an investor in BBOX, is the brains behind Linea, which gives the platform an additional technological edge and layer of synergy.

Investor at Hashed, Edward Tan, is thrilled with BBOX’s cutting-edge technological design:

We think perpetual dexes are among the most lucrative cryptocurrency niches, and we’re thrilled to support BBOX, a group that stands out in a crowded, cutthroat industry. The technology makes capital operate effectively for liquidity providers by utilising Oracle Extractable Value (OEV) for liquidations and a dynamic multi-asset signalling AMM for on-chain traders. We think the greatest individuals are in charge of this product: professionals who are native to the cryptocurrency space and have appropriate backgrounds in engineering, quantitative trading, and traditional finance. Their partnership with the Linea ecosystem will play a significant role in realising their goal.

BBOX was one of the 12 DeFi ideas that Binance Labs chose for series 6 of their incubation season last year.