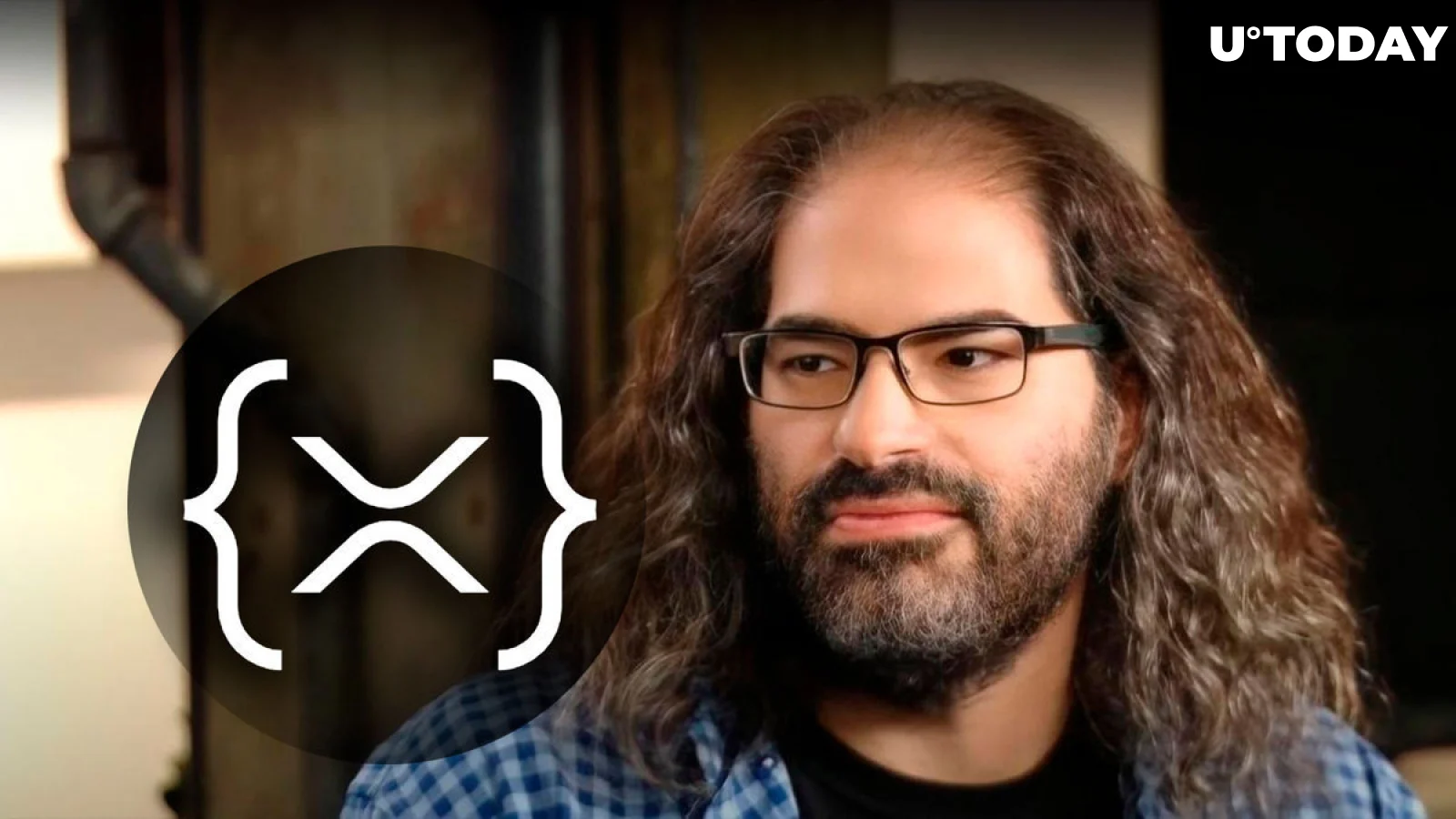

Ripple CTO David Schwartz has spoken out over the impending vote to introduce an automated market maker (AMM) protocol on the ledger’s decentralised exchange, which is a significant step within the XRP Ledger (XRPL) ecosystem. Schwartz addressed concerns on the protracted voting process, which appears to be driven by debates among XRPL validators, in response to questions and arguments from the XRP community.

In response to a community concern, Schwartz spoke with an XRPL enthusiast who brought up three important issues with the planned AMM modification. These included turning on both Oracle and AI functions, limiting deposits to accounts with legitimate or approved DID codes, and guaranteeing that XRP was present on one side of every new Smart AMM.

AMMs provide liquidity when engaging with user-initiated OfferCreate and Payment transactions, according to Schwartz’s clarification.

Why not?

On the other hand, a different validator voiced their concerns, pointing out performance problems such unstable networks and the unresolved online_delete bug. Ever the troubleshooter, Schwartz offered a simple solution to the online_delete problem as well as the idea to test dynamic self-tuning to boost productivity.

https://x.com/JoelKatz/status/1750035684226937170?s=20

The main component of the amendment, AMMs, allow decentralised exchanges by doing away with traditional order books using algorithmic asset pricing. By providing peer-to-peer token trading via smart contract-secured liquidity pools, they reduce exchange costs as token reserves rise.

With a solid 60% agreement and 28 out of 35 votes, the AMM amendment is poised to drastically alter the XRPL environment.