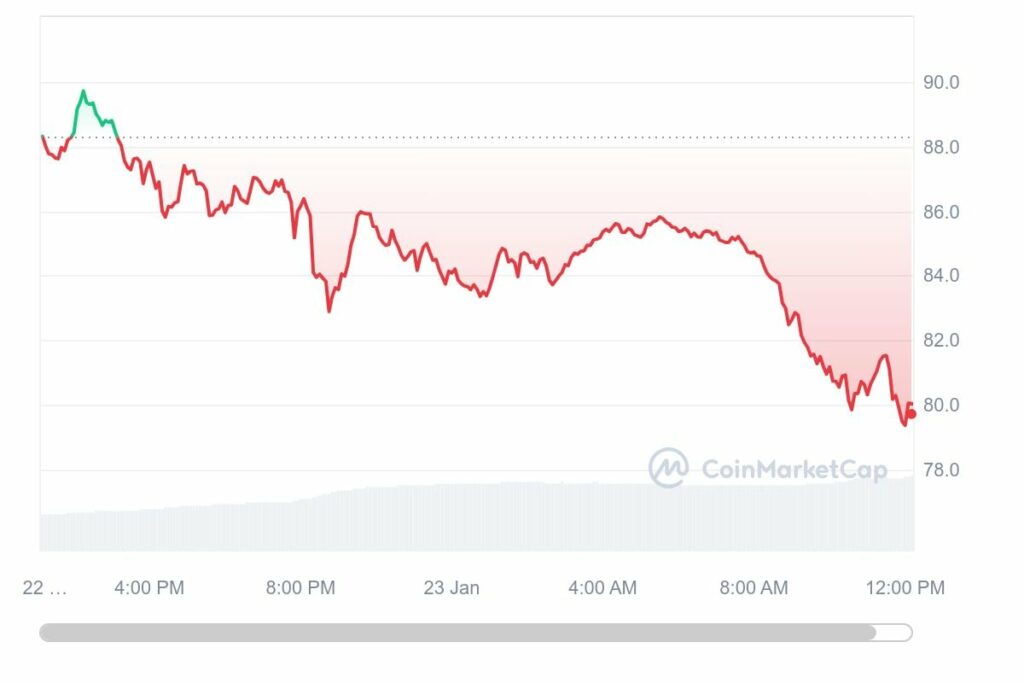

Solana (SOL) does not benefit from the present market structure since it has declined more quickly than its competitors, replicating the high levels of positive volatility that enabled it to record an outstanding surge at the conclusion of the previous year. CoinMarketCap statistics indicates that the Solana price decline for a 24-hour period is estimated to be 8.98%, or $80.51.

The weekly losses have increased to almost 17% due to the daily decline, indicating that the sell-offs in Solana’s price are a persistent trend rather than an isolated incident. Solana reached an annual high of $125.19, exhibiting one of the most remarkable growth trends thus far this year.

With its spiralling downward growth, Solana’s over 700% year-over-year (YoY) increase in 2023 raised serious concerns about the protocol’s future. Based on prevailing patterns, it seems that the Solana bubble broke because older investors had plenty of time to cash in on the brief spike to a multiyear peak.

The prognosis of the meme currencies established on top of the burst Solana bubble is also indicative of that. Meme currencies like BONK and Dogwifhat (WIF) are currently under tremendous selling pressure as investors are drawing back after a string of bullish monster rallies.

Potential Solana growth catalysts in view

The fact that the current Solana slump is a comprehensive market phenomenon is one comforting aspect about it. The anticipated favourable growth tendencies for Bitcoin that might impact the overall market have not materialised as a result of the development of spot Bitcoin ETFs.

One significant Solana trigger will be to witness a turnaround in the larger coin’s negative trend, as Bitcoin has been prominently guiding the altcoin market decline. Furthermore, the anticipation for the upcoming Solana Mobile update and its potential to attract new users is a positive catalyst that has the potential to alter SOL’s story in the medium to long run.