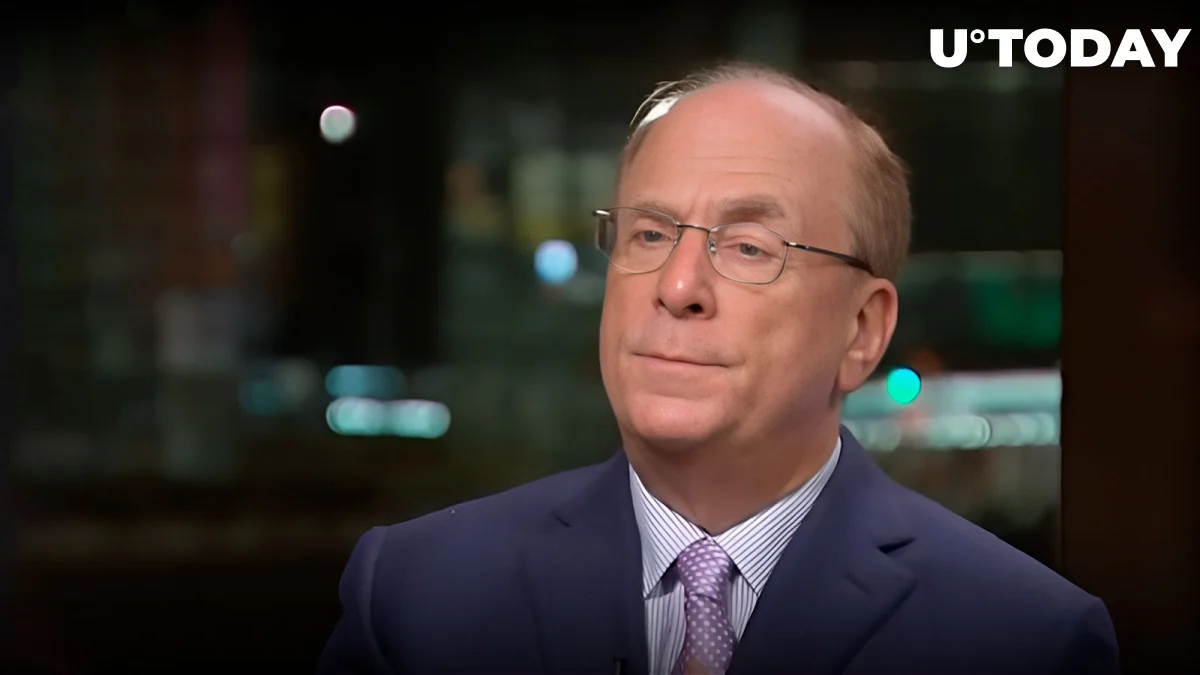

The XRP community is abuzz with conjecture after BlackRock CEO Larry Fink’s enigmatic statement on the possibilities for an XRP Exchange-Traded Fund (ETF).

When questioned about an XRP ETF in a recent Fox Business interview, Fink said, “I can’t talk about that!”

Investors and experts are interpreting his enigmatic statement for potential clues about BlackRock’s potential entry into XRP. Contributing financial writer Charles Gasparino observed that Fink was becoming more fluent in Ethereum but acknowledged that he was not as familiar with XRP.

Fink’s Bitcoin journey

The story of Larry Fink’s bitcoin U-turn reflects a larger change in the financial industry.

In an interview with Fox Business, Fink recounted how he came to see Bitcoin as a “digital gold” after first seeing it as a means of facilitating illegal activity.

Fink openly shared his early misgivings about Bitcoin, agreeing with Gary that it was a tool for illegal activity. “I think no one can deny that it’s still one of the vehicles for illicit activity,” Fink said, expressing his belief in line with Gary’s viewpoint.

He now recognises the value of Bitcoin as a safe haven in nations experiencing political or economic unrest, comparing it to a global ledger that operates outside of national borders.

In response to worries about the unscrupulous actors in the cryptocurrency market, Fink said that while there are dishonest individuals, the industry is becoming more and more legitimate. He noted the launch of the Bitcoin ETF as a critical step in creating validity and safety inside the cryptocurrency sector. “There are a lot of bad players in all startup things but I think it’s become more legitimised,” he added.

Fink’s changing position and his admission that Bitcoin ETFs give legitimacy to the cryptocurrency world suggest that the titan of finance is slowly but surely coming around to digital currencies.

After Bitcoin ETF approval, will XRP follow?

The SEC’s approval of Bitcoin spot ETFs paved the way for other cryptocurrencies to do the same.

As reported by U.Today, Valkyrie Funds’ co-founder, Steve McClurg, in a Bloomberg interview, voiced confidence for Ethereum and XRP ETFs in the aftermath of Bitcoin’s acceptance.

Market developments that support his opinions include Grayscale’s decision to include XRP in its tradable trusts, which suggests that there is a growing demand for a variety of cryptocurrency investment products.

Though Valkyrie isn’t sure if it will introduce Ethereum or Ripple exchange-traded funds (ETFs), this indicates that the general public is becoming more and more interested in cryptocurrencies.

It’s important to note that Brad Garlinghouse, CEO of Ripple, recently praised the SEC’s approval of Bitcoin spot ETFs, seeing it as a critical step towards the mainstreaming of cryptocurrencies as an asset class.