Former Ark Invest analyst Chris Burniske recently shared his thoughts on the booming cryptocurrency sector on Twitter. Burniske, who is well-known for his insightful market analysis, issued a warning, stating that the upward trajectory of the cryptocurrency market may not last. He said, “The very beginning — but there will be periods of cool ahead, it doesn’t stay white hot like this for more than a few months max — skip on.”

Burniske’s tweet suggests that even if the market is starting a strong period, it is not feasible to think that the momentum will hold at this high point. Both traditional and cryptocurrency markets have seen ups and downs in the past. Rapid development stages are frequently followed by cooling-off periods during which the market consolidates before determining its course.

Looking more closely at Burniske’s ideas, we see that he divides well-known cryptocurrencies into two categories: “SOL and TIA the integrated + modular barbell” and “BTC and ETH the OG crypto barbell.” This categorization implies that Solana (SOL) and TIA are next-generation blockchain platforms that offer a combination of integrated and modular functions, while Bitcoin (BTC) and Ethereum (ETH) continue to be the industry heavyweights.

A counterargument to Burniske’s thesis, however, would contend that although BTC and ETH have demonstrated their durability and market attractiveness over time, it is too soon to lump more recent entries like SOL and TIA into the same category. Even while they show promise, these more recent platforms must withstand market turbulence, time, and regulatory obstacles.

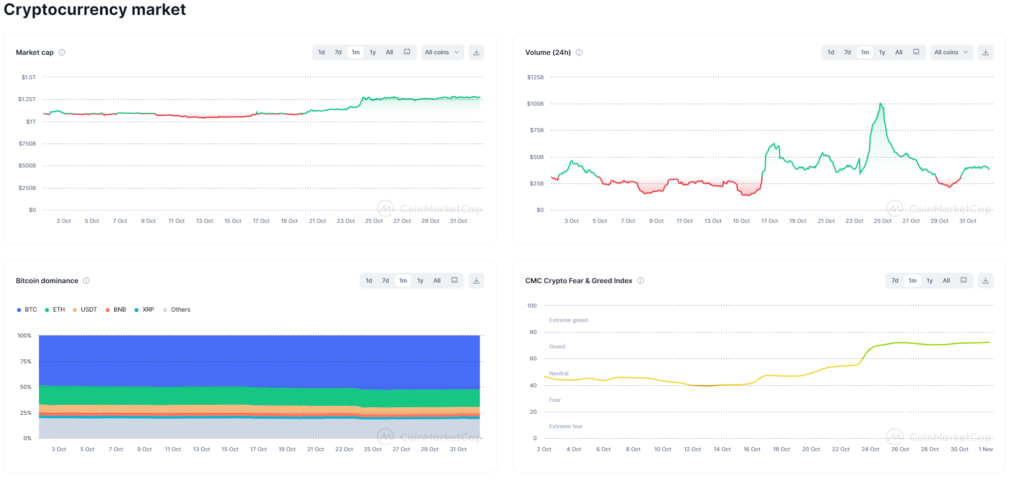

Overall market mood is further illustrated by the cryptocurrency market chart. The market capitalization graph shows consistent rise, suggesting a bright outlook. The 24-hour volume graph, on the other hand, displays volatility with distinct peaks and troughs. While the CMC Crypto Fear & Greed Index swings between “greed” and “neutral,” suggesting that traders are wary but hopeful, the Bitcoin dominance chart shows a consistent proportion of BTC on the market.