According to a new Bernstein forecast, the leading cryptocurrency, Bitcoin, may reach a value of $150,000 by the middle of 2025.

Given that it is presently selling at $34,400, a 336% increase in value would be required.

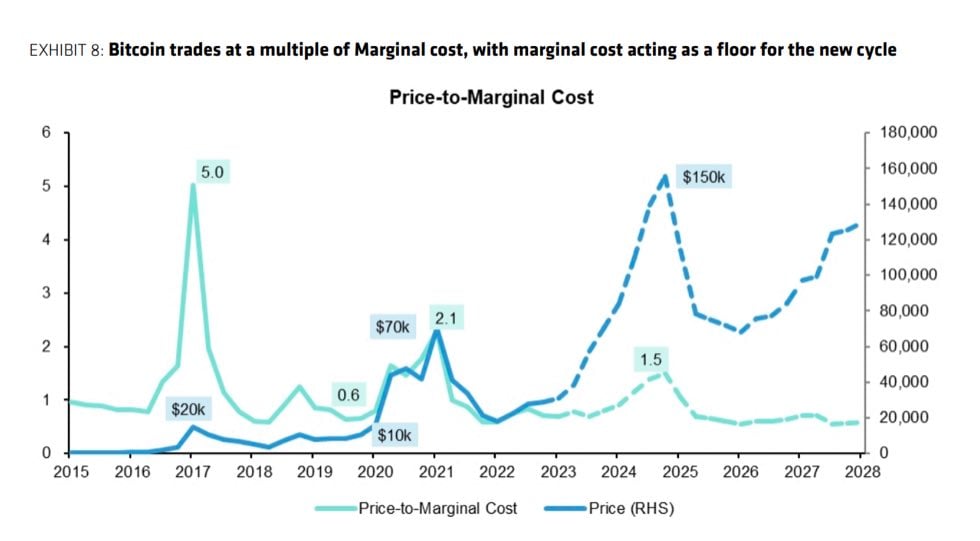

Bitcoin’s price-to-margin cost

The historical correlation between the price of Bitcoin and its price-to-marginal cost is shown by Bernstein’s. This measure is important because it shows how much Bitcoin trades for above its production costs, giving traders and the general market sentiment a better understanding of prospective profitability for miners.

When Bitcoin’s price hit 5.0 times its marginal cost in 2017, it shot up to an all-time high of almost $20,000. At a later peak in 2019, the multiplier reached 2.1, corresponding to a $70,000 price tag—a little smaller peak than the 2017 increase. The price multiplier of 1.5 is predicted for the 2024–2027 cycle, which is consistent with the previously reported possible price of $150,000 by mid–2025.

The chart’s dips also show that the price of bitcoin seldom ever falls below its marginal cost. This supports the idea that marginal cost serves as a “floor” or support level.

For example, the price was slightly over the marginal cost line in 2020 and 2021, indicating very stable years.

The ETF hype

The research group recently investigated the potential effects of a spot Bitcoin ETF approval in the United States, as reported by U.Today.

Bernstein predicts that within three years, exchange-traded funds might make up as much as 10% of the market value of Bitcoin if they receive approval. This is an important consideration, particularly in light of the fact that the Grayscale Bitcoin Trust already accounts for about 4% of total Bitcoin ownership.

Recently, the company has positioned Bitcoin as a better asset than gold, referring to it as a “faster horse.”