CurveFi creator Michael Egorov has been involved in a flurry of transactions over the past few days, unloading a significant number of CRV tokens in an astonishing chain of events. The quick divestment has sparked conjecture and anxiety among the cryptocurrency community.

In under three hours, Egorov sold 1.25 million CRV to Stake DAO Governance and 3.75 million CRV to Yearn Treasury. This comes after a prior sale of $59.5 million in cash return value to 13 investors/institutions for $23.8 million in just two days.

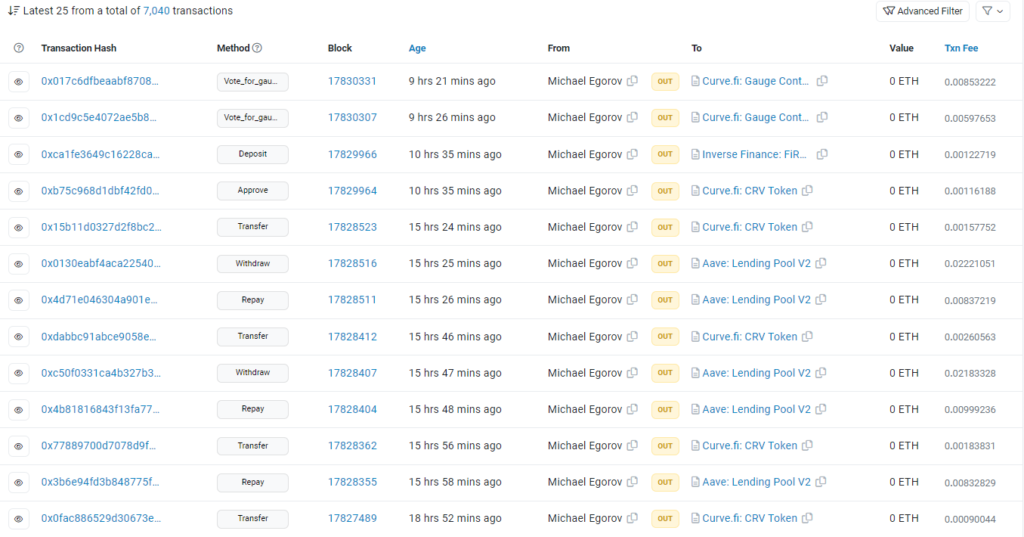

Additionally, Egorov gave back $3 million USDT via the decentralised financial network Aave. This latest behaviour is in line with Egorov’s mounting debt, which is presently spread over other DeFi platforms, such as Aave, Abracadabra, Fraxlend, Inverse, and Silo, and stands at an unsettling $82.6 million.

These transactions appear to be urgent because of an action taken by Abracadabra protocol, one of Egorov’s debtors. Magic Money, aka Abracadabra, has unilaterally suggested raising the base interest rate on big loans to 200% per year.

This measure would only be applicable in the event that the loan collateral, subject to a 5x multiplier, is twice the loan amount. This may compel Egorov to give back $14.5 million in stablecoins.

Egorov is in a risky situation because to Abracadabra’s significant spike in attention and the possible consequences. The quick sales and repayments appear to be a calculated strategy to lessen any possible negative effects of this abrupt transition. The Curvefi community is watching developments with anxiety and is on high alert.

Although the long-term effects of these transactions on the Curvefi ecosystem are hard to anticipate, Egorov’s calculated unloading of CRV tokens emphasises how crucial it is to retain a high level of debt while being as liquid as possible.