According to statistics from IntoTheBlock, short-term traders are becoming more interested in Shiba Inu (SHIB), with a rise of 84% over the previous 30 days.

Based on how long an address has held a certain cryptocurrency asset, IntoTheBlock compiles addresses. The following groups these addresses: “Hodlers” are long-term investors, “Cruisers” are mid-term or “swing traders,” and “Traders” are short-term speculators.

Hodlers make up 69% of all Shiba Inu addresses, cruisers or midterm traders make up 27%, and traders make up 4%, according to these categories.

Hodler addresses are those that have owned SHIB for more than a year, Cruiser addresses are those that have held for one to twelve months, and Trader addresses are those that have held for less than one month.

Hodlers may have continued to increase as a result of further new use cases made possible by inventions like ShibaSwap, Shibarium, Shiba Eternity, and others since these long-term addresses may have desired to cling onto their holdings in order to take advantage of these technologies.

SHIB price shift imminent

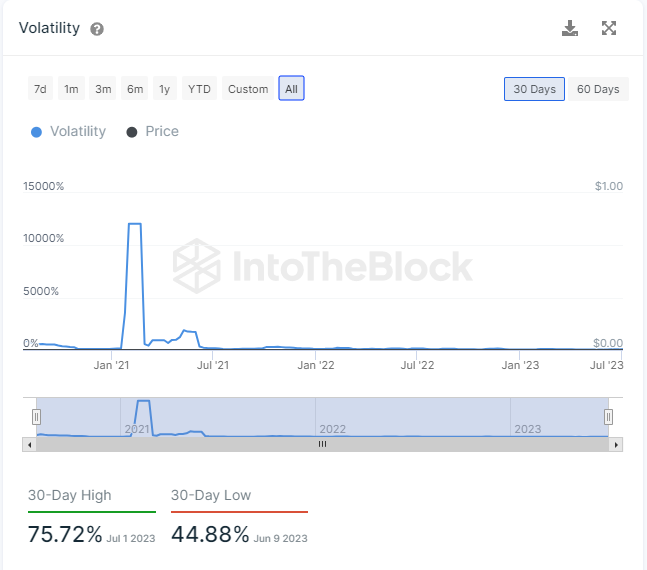

The volatility indicator from IntoTheBlock tracks changes in price for a particular cryptocurrency asset. Shiba Inu volatility as of right now is 70.24%. In the previous 30 days, July 1 had the most volatility, at 75.72%.

High volatility typically translates into significant price changes (either up or down). On the other side, little volatility suggests that prices are stagnant.

Large increases in volatility typically signal a change in trend. Therefore, periods of exceptionally high volatility may be a sign that the price may be about to reverse course and move in the direction of the mean. Low volatility, meanwhile, frequently signals a forthcoming major breakout in either direction.

SHIB had lost 2.52% in the previous day as of the writing and was now trading at $0.0000075.