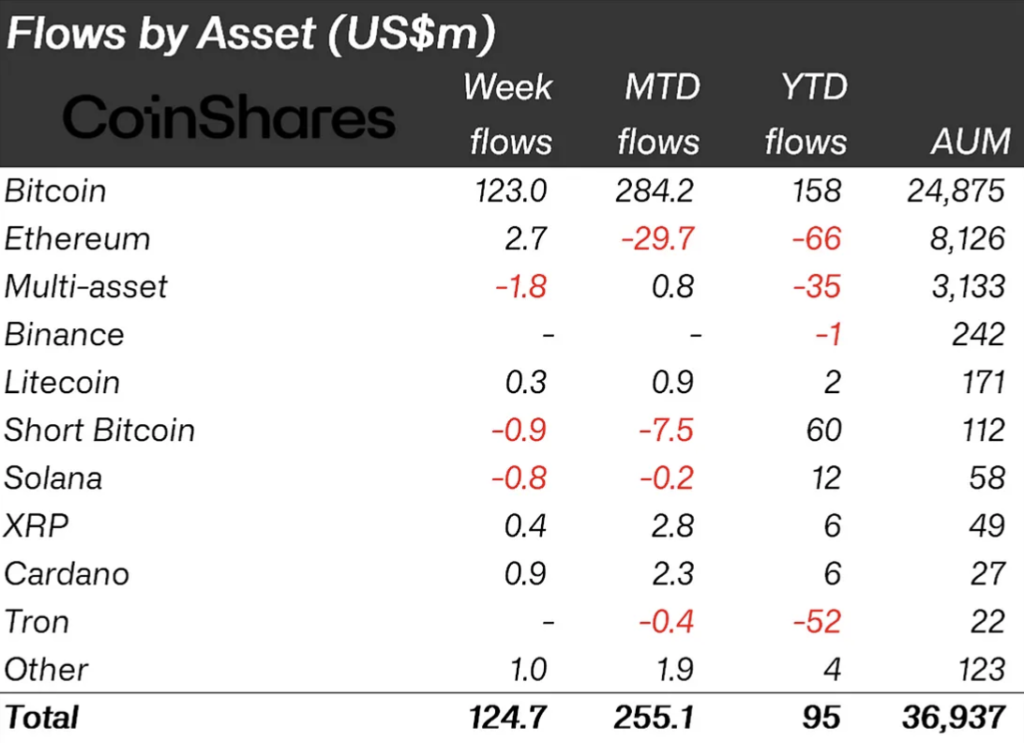

A whopping $125 million poured into digital asset investment products during a spectacular week for the cryptocurrency market. With an extraordinary influx of $123 million, Bitcoin (BTC) was without a doubt the major focus of investors’ attention. However, XRP came itself as the top performer, bringing in almost $400,000 and maintaining its upward trend.

In June alone, XRP exchange-traded products brought in $2.8 million, surpassing every other cryptocurrency, according to the most recent weekly data from CoinShares. XRP products have received an outstanding $6 million in fund flows since the start of 2023.

Why would traditional investors bet on XRP?

There are two main reasons for this unique perspective towards XRP. The first is the coin’s strong relationship with Ripple, which actively uses it in commercial transactions. Many investors view XRP as a great way to participate in Ripple’s development due to the company’s ongoing expansion and relationships with companies in conventional sectors. This idea is further supported by the idea that Ripple’s actions are what are causing the price of XRP to increase.

The second reason is the ongoing legal battle, now in its third year, between Ripple and the SEC. Despite the protracted ambiguity, some experts predict that a definitive answer could be approaching. As a result, investors are utilising the chance to advance the court ruling, which has raised interest in and investment in XRP.

The ongoing positive inflows of XRP illustrate its endurance and attraction to investors looking for a variety of alternatives within the crypto environment, even though Bitcoin continues to be the dominating force.