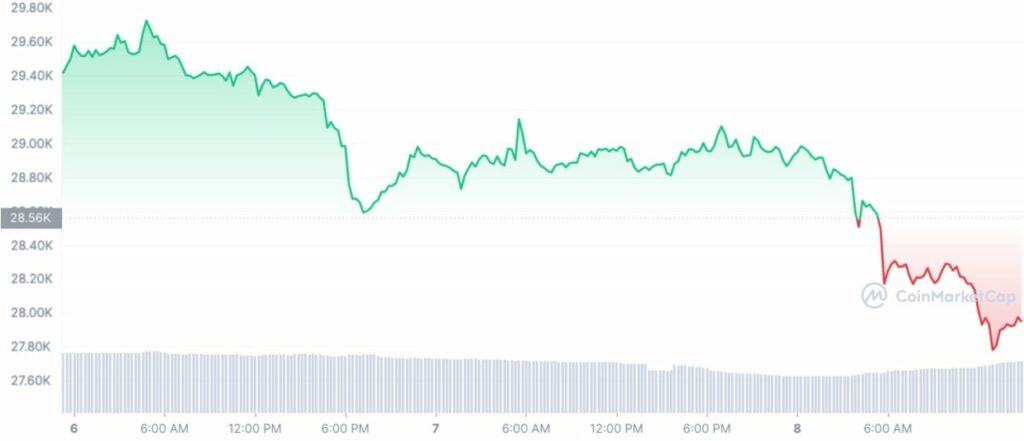

Since the start of the current trading session, the price of Bitcoin (BTC) has decreased by 1.8%. The downturn caused the quotes to drop below the $28,000 per BTC threshold and to hit their lowest value in recent weeks. The price of Bitcoin has now reentered the dynamic channel, although it is unclear if it will be able to do so indefinitely. However, there is something that could be able to prevent BTC from falling even lower.

The important support range for Bitcoin is currently between $27,100 and $27,980, as evidenced by statistics from the crypto intelligence portal IntoTheBlock, where more over 1.28 million addresses have bought 458 BTC. To stop a further decline to levels at least as low as $25,480, this “wall of demand” must hold.

On the other hand, the price of Bitcoin has to exceed $29,600 in order to increase from the current levels. The analysis shows that there are 1.72 million Bitcoins at 3.37 million addresses between that level and the current price of the cryptocurrency. Now losses are occurring at such addresses.

It’s critical to understand that the current BTC price fluctuation is not happening in a vacuum. Many cryptocurrencies have seen substantial price changes recently, and the overall cryptocurrency market has been going through a period of instability.

The pressure of the “Sell in May” slogan combined with the possibility of a recession, which might start as early as July, makes selling off the most sensible course of action. Additionally, the meme season that has been going on for the past three weeks might also be considered a warning sign.