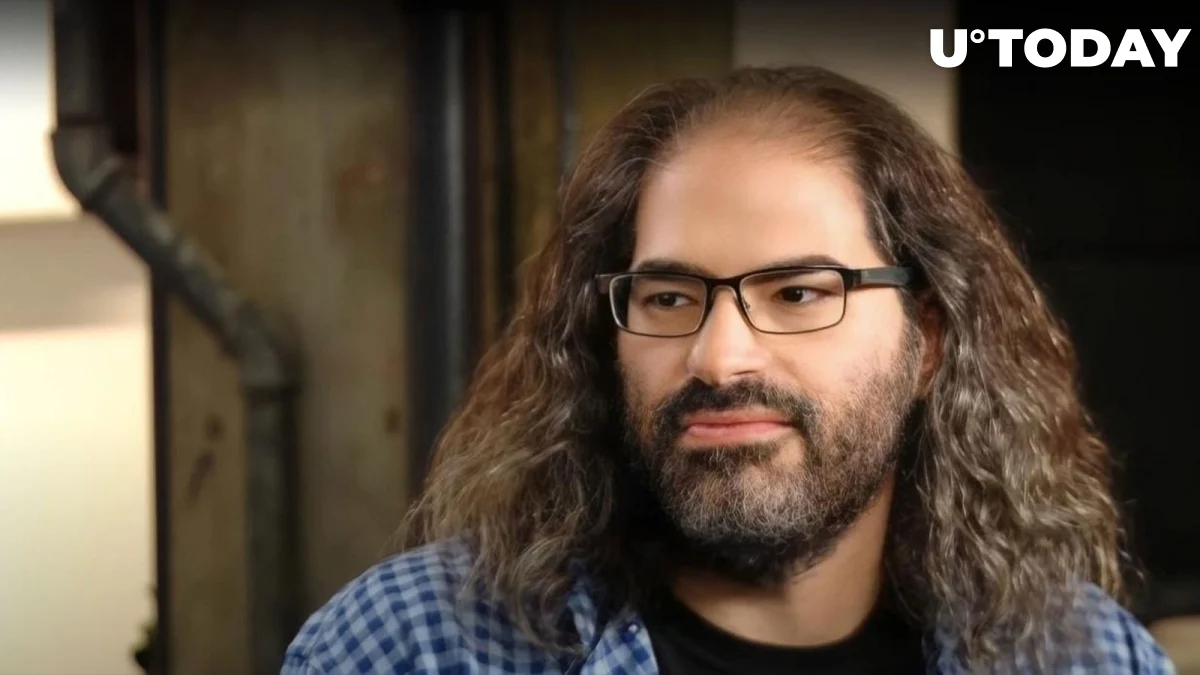

On Twitter, Ripple CTO David Schwartz clarified the organization’s prefunding approach for XRP, a topic that has recently been the subject of discussions.

In response to a debate about Ripple’s nostro/vostro accounts and prefunding, Schwartz clarified that users can prefund in only one account and send payments to any On-Demand Liquidity (ODL) destination market rather than prefunding in every market.

The versatility of Ripple’s system was also emphasised by Schwartz, who noted that users might retain their money in a favoured asset while making payments in a different one.

He stressed the distinction between prefunding MXN to make USD->MXN payments vs storing USD to do so. Customers are given more control over their money because to this flexibility, which also eliminates the need for several pre-funded accounts.

Schwartz affirmed that Ripple may prefund accounts using their own XRP at very much free cost for the line of credit option. The business does, however, assume some credit risk and must charge for that in accordance. Since that Ripple is providing the prefunding cash in XRP in this case, liability is transferred to them in exchange for a charge.

Schwartz acknowledged that there is a non-zero chance that the client would not pay the firm back for the XRP, particularly if a customer’s cash are housed in a bank that fails or goes bankrupt for whatever reason, despite the fact that Ripple taking on some credit risk.