IC Markets is a global CFD broker that was established in 2007 and has been growing steadily since then.

They offer their clients the opportunity to trade an extensive range of assets with true ECN capability. This means that traders are able to get some of the lowest spreads on the market with near-instant execution.

However, is IC Markets safe and can you trust them?

In this IC Markets review, we will give you everything that we found out about this broker. We will also give you some essential hints and tips that help your trading experience.

Overview

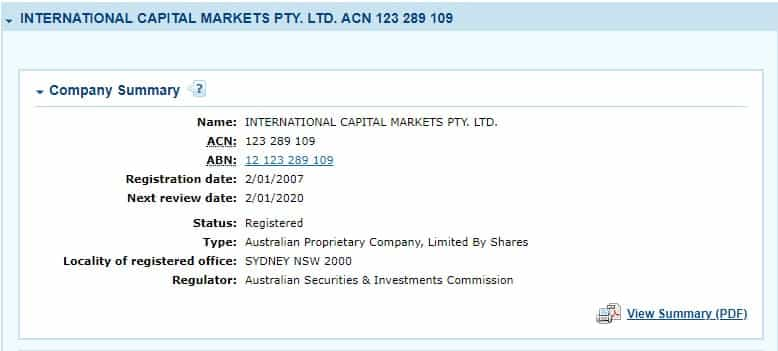

IC Markets is registered International Capital Markets Pty. Ltd and they are based in Australia. Their company registration number is ACN 123289109 and their offices are located at Level 6 309 Kent Street, Sydney.

They have expanded rapidly since their inception and have over 60,000 traders with them. They also process some of the highest volume in the industry and turn over $646bn in volume per month! You can see their trading stats right on their website.

IC Markets is an Electronic Crossing Network (ECN) broker. This means that they connect their traders directly to a pool of liquidity providers. This allows the traders to get tight raw market spreads on a number of assets.

They have a global presence and take traders from numerous regions. In order to cater to such a large array of clients, they have translated their website into over 14 different languages.

Despite this though, there are some regions that they do not provide their services to. These include the Unites States, Canada, Israel and Iran.

Is IC Markets Safe?

This is probably one of the biggest concerns for any Forex trader.

There are number of things that we look for when determining broker safety. The most important of these are the regulatory oversight and the internal protocols at the broker.

Regulation

You will be pleased to know that IC Markets is fully regulated by Australia’s Securities and Investment Commission (ASIC). They have an AFSL number of 335692.

The Australian regulators are some of the most reputable in the world and there are a number of benefits that come with their oversight. These relate to the rules that they place on brokers and how they conduct their business. Here are some of the most important of them:

- Segregated Accounts: ASIC requires that brokers keep their client’s funds in separate bank accounts from the main broker operations.

- Capital Reserves: The regulator stipulates that the broker must store A$1m in reserves in their bank accounts.

- Regular Reporting: Brokers are required to maintain these levels and regularly report back to ASIC.

- Extensive Due Diligence: Before a broker can get an ASIC licence, they will have to complete a series of background checks on a company and individual level.

Apart from these client protections, you also have the comfort of knowing that there is always some authority that you can turn to in the case of a dispute.

Asset Coverage & Leverage

This was something that really impressed us about IC Markets. They have an extensive range of assets across numerous asset classes.

Exactly what assets you will be able to trade depends on the account that you open up and the platform that you use. We cover the platforms below but here is a sneak peak of the assets that they provide:

- Forex: 60 Pairs covering all Majors and most Minors

- Indices: You can trade over 7 indices from a number of global markets

- Commodities: You have 14 commodity CFDs including hard, soft and most metals

- Stocks: They offer 120 single stock CFDs from the ASX, NYSE and Nasdaq

- Crypto: You have 10 crypto assets including Bitcoin, Litecoin, Ethereum etc.

- Bonds: 6 different government bond indices.

- Futures: Futures on Oil, VIX, ICE.

This is one of the first CFD brokers that we have seen offering government bonds! Now you can trade the credit worthiness of the US and UK governments for example.

Leverage

Given that IC Markets is a CFD broker, it means that you are trading on the margin with borrowed money. This means that your positions are leveraged by a certain factor and your gains / losses are maximized.

Leverage at IC Markets will vary depending on the asset that you are trading and the size of the position. However, here is a helpful breakdown of the max leverage you can achieve on each asset class:

- Forex: 500:1

- Commodities: 500:1

- Indices: 200:1

- Futures: 200:1

- Bonds: 200:1

- Stocks: 20:1

- Crypto: 20:1

These are reasonable leverage levels. The minimum leverage that you can trade with is 1:1 so there is no need for you to trade with the max when you first start.

While the crypto leverage factor is better than most other CFD brokers, you can trade with higher leverage in other locations. For example, you could trade CFDs at IQ Option or Futures at Prime XBT.

IC Markets Spreads

The size of the broker spreads directly impacts on trading profitability and is hence a really important criterion for us.

Given that IC Markets operates an ECN model, the spreads that you are charged are really thin. For example, if you have a True ECN account, you are able to get close to 0 spreads on some of the major Forex pairs.

Of course, the exact spread that will be applied depends on the type of asset you are trading and the account you have. Below is an indication of some of the spreads on a small subset of assets on the Standard / True ECN (in pips).

- EURUSD: 0.1 / 1.1

- GBPUSD: 0.4 / 1.4

- USDJPY: 0.2 / 1.2

- Brent: 0.05 / 1.05

- Gold: 0.09 / 1.09

- Aus200: 5 / 5

- US500: 0.6 / 0.6

- US 10YR T-Bill: 0.06 / 0.06

- BTC: 20 / 20

These are pretty thin spreads and are lower than some of those that we have seen at other brokers such as Plus500.

Take note though that although the True ECN has a lower spread, you will have to pay a commission on the lots that you trade. This is $3.5 per lot and $0.035 if you are trading the Micro Lots. If you are on cTrader, you are charged $3 per 100k lot.

As is standard with Forex brokers, you will also be charged a standard swap rate. This can be considered an “overnight” fee that is charged to finance your positions. You can see this swap rate in the platforms before you enter the trades.

IC Markets Account Types

As mentioned above, their are quite a few account types that you can open at IC Markets. These will differ in the types of spreads you will be charged, the platform that you will use and the subsequent assets that you can trade.

All of the accounts below make use of ECNs which connect directly to the liquidity providers. This means that IC Markets operates a “no dealing desk” model and is not the market maker to any of the trades that you are putting on.

Below is a breakdown of the different account types:

| True ECN (cTrader) | True ECN | Standard | |

| Trading Platform | cTrader | MetaTrader | MetaTrader |

| Commission (per lot) | $3.0 | $3.5 | $0.0 |

| Spreads from (pips) | 0.0 | 0.0 | 1.0 |

| Server Location | London | New York | New York |

| CNS VPS Cross Connect | No | Yes | Yes |

| Programming Language | C# | MQL4 | MQL4 |

| Suitable For | Day Traders & Scalpers | MetaTrader | MetaTrader |

| Trading Platform | cTrader | EAs & Scalpers | Discretionary Traders |

All of the accounts above have Microlots which facilitate flexible lot sizing. These Micro-lots start at just 0.01 lots. The minimum deposit amount on all accounts it $200.

IC Markets Mobile App

While IC Markets does not develop their own proprietary mobile application, each of the trading platforms that were mentioned above have their own mobile apps.

The MT4 and MT5 mobile apps are perhaps some of the most popular trading application in existence today. For example, the former has been downloaded 10m+ times and the latter has been downloaded 1m+.

They are available in iOS and Android and have a range of features. You have one click trading, order management as well as relatively advanced charting. You can also easily toggle between the different markets.

You can also take a deeper look at the reviews for the MT4 and MT5 mobile apps in the iTunes store and the Google Play Store. They are all above 4.5 stars and most of the traders are quite complimentary.

Funding / Withdrawals

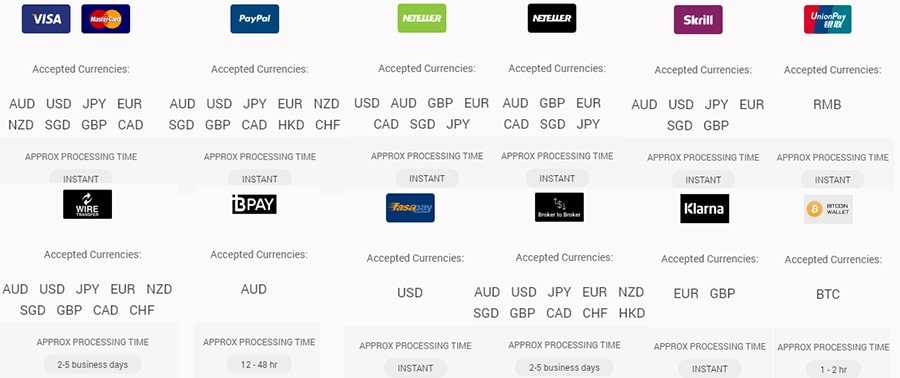

Once you have tested the Demo and are ready to fund a live account, there are a number of ways in which you can do this.

You can fund your account in the following currencies: AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, CHF. Funding can be done pretty easily directly from your IC Markets admin area.

Below are the funding methods that you have at IC Markets:

IC Markets Execution

One of the biggest benefits of IC Markets is their trading infrastructure.

Firstly, they use some of the best-known liquidity providers in the world including the likes of Citi, UBS, JP Morgan and Goldman Sachs. They also use dark pools for hidden sources of liquidity.

IC Markets also uses the Equinix datacentres in New Jersey and London. These are the same datacentres that are used by High Frequency Trading (HFT) firms to execute their lightning fast strategies.

In the case of the New Jersey datacentre, this is used by numerous large institutions on Wall Street. Some of these are the same institutions that provide liquidity to IC Markets that I mentioned above.

When you place an order at IC Markets, it can be routed to the liquidity network with fibre optic cabling almost instantaneously. The faster that your order can be executed, the better your overall order fills.

Final Word

Our IC Markets review found them to be a well regarded and regulated broker with low fees, instant execution and extensive asset coverage.

Moreover, they use some of the most advanced trading technology in the industry in the MetaTrader and cTrader platforms. They have also supplemented this with additional trading tools and resources.

Yes, there are things that we think they can improve, but these can easily be worked on. Hiring better customer service or starting a weekly webinar is not too hard to implement.