What is Augur?

Augur is a decentralized market platform for making predictions. As an ERC20 token it uses the Ethereum network to harness the “Wisdom of the Crowd” and make predictions on real world events.

It’s notable that this “crowdfunding” of predictive ability has actually produced many results that are more accurate than those of top experts in the fields being predicted. Predictions are nothing new, in fact in many circles it would be called gambling, while in others it goes under the guise of “analysis”.

Augur actually goes further than this I think, and by utilizing blockchain technology, Augur aims to enable predictive communities that have greater accessibility, lower fees and greater accuracy than anything seen previously.

What is a Prediction Market?

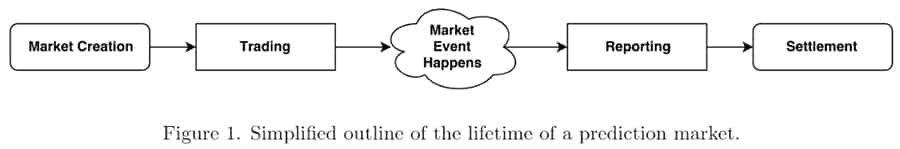

Before getting into the nitty-gritty of Augur let’s first get a better understanding of just what a prediction market is. As you might have guessed, it is pretty much just what it sounds like – an exchange-traded market that is used to predict future events.

In the Augur market participants can buy and sell shares on the outcome of future events, with the pricing dictated by the crowdsourced likelihood of the event occurring.

Research indicates that prediction markets can be more reliable than institutions who employ pools of experts.

Predictive markets are nothing new, with records of predictive markets for political betting stretching back to 1503. They use something called the “Wisdom of the Crowd” to generate generally accurate estimates of the outcome of events. The underlying premise is that with a large enough sample size answers tend to be just as accurate or more so than the answers you would get from an individual expert, or even from a small group of experts.

This is the principle being used by the Augur team to create accurate forecasts and predictions of the future outcome of events.

The Market for Prediction Markets

While it might sound like prediction markets are just another form of gambling, or some gimmick, the fact is that they are considered to be quite valuable when implemented properly.

The “wisdom of the crowd” can lead to stunningly accurate predictions, and eventually will also enable markets to operate more efficiently. Both Google and Ford Motor Company have been using predictive markets internally for over a decade, although the data has been slow to make it to the decision making process.

While these internal markets were used mostly to gauge the effectiveness of in-house processes, predictive markets can be used in the realm of financial markets as well.

There is some consensus that predictive market modeling could be used to hedge investments based on certain corporate behaviors, such as earnings reports, changes in dividends or stock buyback programs, management changes, and acquisitions.

One interesting use of predictive markets is as a form of insurance in developing countries, where citizens have no other effective way to hedge against political, financial, or even climate risks.

The Augur Team and History

Augur was one of the very first platforms built on the Ethereum network, having been started in October 2014 by a 13-person team led by Jack Peterson and Joey Krug.

Previous to their work on Augur the two gained experience with blockchain technology when they created Sidecoin, a fork of Bitcoin. In addition to the experienced team at Augur, Vitalik Buterin, the creator of Ethereum, is an advisor to the project.

The first public alpha version of Augur was released in June 2015, and that year Coinbase selected Augur as one of the most exciting blockchain projects of 2015. This is likely the root of rumors that Coinbase would add the Augur token – REP – as one of their few available coins. The beta version of Augur was released in March 2016.

The biggest Augur competitor is Gnosis (GNO), which is also built on the Ethereum network and is a very similar project, with an equally talented and experienced development team.

The primary difference between the two projects comes down to the economic models being used. While Augur uses a fee based model based on trading volume, Gnosis has fees that are based on the number of outstanding shares.

How Augur Works

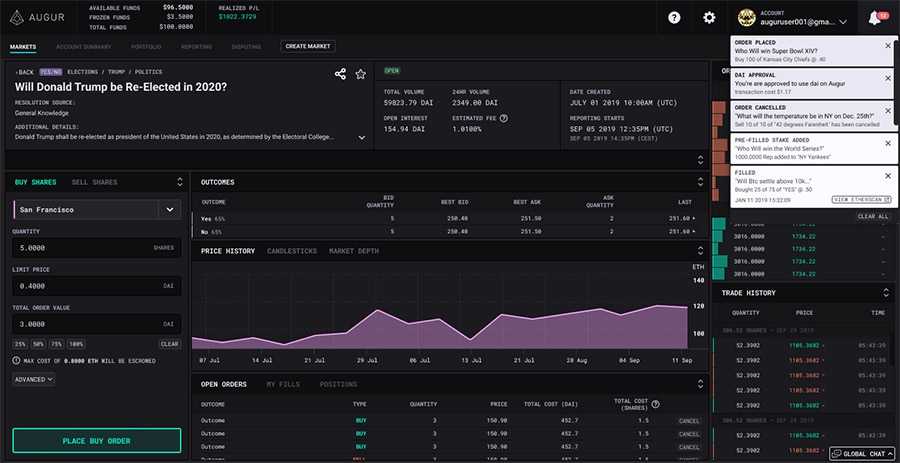

As you’ve probably already figured out, Augur is meant to be a prediction market platform that will pay users for making correct predictions regarding world events. In addition, the creators of the markets and the holders of REP tokens, who will report on events, will also be rewarded.

Predictions in the market are made by trading shares in the outcome of real-world events. If you think the Patriots will win the Superbowl, The Dow will hit 30,000 or North Korea will shut down their nuclear program by 2020 you can buy shares in those outcomes. If you purchase shares in the correct outcome you profit.

The profits you can make are determined by the likelihood of an event happening, as determined by the crowd. Each share has a value of 1 ETH.

If there are even odds of an event happening you would pay 0.50 ETH for a share, and if the event does happen you get paid 1 ETH. If the event does not happen you’ve lost your 0.50 ETH or however much you spent to purchase your shares.

Share prices will change over time, with the price rising as more people buy shares, and falling if people are selling their shares. This makes it possible to buy shares at a low price and then sell them at a higher price as more people bet on the occurrence of an event – even before the final results are known.

The Augur platform was fully deployed on July 9, 2018 and has been growing since. Version 2 of the platform is due to launch in January 2020, and will be significantly faster than the v1 production platform. It will also allow for instant settlements, so those making wagers on the Augur platform will no longer need to wait for their payout.

REP (Reputation) Tokens

The REP (or Reputation) tokens are what powers the Augur Decentralized Oracle System. You can think of it as the means to “score” events on the Augur platform. Holders of REP tokens can use them as a stake to report on the outcome of the events listed in the marketplace.

REP tokens are not an investment, as they don’t pay passively. Instead they are a tool that helps Augur work. Most users of Augur will never own a REP token, and may not even understand its use. It is important to understand why it exists and what use it has though to fully understand how the Augur platform works.

Augur has limited the supply of REP tokens to 11 million, 80% of which were sold in their ICO. The holders of REP tokens are considered to be “Reporters” and are expected to accurately report the outcome of the random events listed on the Augur marketplace at least every few weeks.

If these “Reporters” fail to report, or report inaccurately, the Reputation of those individuals is redistributed evenly to all the Reporters who did report accurately during the same reporting cycle.

The Benefits of Owning REP Tokens

Owning REP or Reputation entitles you to be a Reporter, and by accurately reporting on the outcome of events in the marketplace you get to share in the market fees imposed by Augur. Each REP token entitles you to 1/22,000,000 of the total market fees collected by Augur for an event.

Obviously, the more REP tokens you own, and the more accurate reporting you do, the more fees you will collect.

Price History of REP

The Augur ICO was held in August 2015 at which time 8.8 million REP tokens were distributed. There are currently 11 million REP tokens in circulation, and that is the total amount that will ever be created.

Immediately following the ICO the REP token traded between $1.50 and $2.00. Since that time the coin has seen three significant price spikes. The first occurred in conjunction with the beta release of Augur in March 2016 and saw price trade just above $16.00.

The next spike was in October 2016 when the ICO tokens were released to investors. At that time price went to just above $18.00, but quickly retreated as many ICO investors dumped their coins for a quick profit. This is a common occurrence in cryptocurrencies when ICO coins are released.

Final Word

Augur was one of the first serious blockchain projects out there, and one of the first to use the ERC20 token and Ethereum network.

The fact that it took over three years of development for the project to come out of beta did hurt the reputation of the platform, and over a year following the launch of the mainnet we see slow, but steady growth as users and investors come back to the project.

Even more encouraging, if it is launched as planned, is the coming version 2 platform, which promises improvements related to speed, reporting, and the user interface itself. That January 2020 launch could be the real start of growth for the Augur project.