BitMEX was started in 2014 by former Citibank trader Arthur Hayes as well as Samuel Reed and Ben Delo. BitMEX was originally located in Hong Kong but is now headquartered in Seychelles.

The holding company is called HDR Global Trading Limited, which is registered in Seychelles. This is a structure that many Bitcoin-related businesses and exchanges tend to choose given the tax efficiency.

BitMEX is a margin trading exchange. This means that you will trade leveraged positions with coins placed on margin. Margin trading is not for all traders and can be really risky. This is especially true in the case of BitMEX where margins can run to 100 times.

One of the great advantages of margin trading is that it allows the trader to short the price of the cryptocurrency. This means that they can make money on the fall in the price of the asset by short selling it.

Another thing that distinguishes BitMEX from numerous other exchanges is that they do not accept Fiat deposits. You can only fund in Bitcoin and withdraw in Bitcoin.

Is BitMEX Safe?

Arguably one of the most important factors when you are choosing an exchange is the security procedures they implement.

To this day, BitMEX has not suffered any hacks. This could be down to their advanced security practices, which you can read about in more detail on the BitMEX FAQ page. They break their exchange policies down by function:

Wallets

The wallets are secured with multi-signature deposits and withdrawals. This means that BTC from the exchange’s cold stored wallets cannot be spent until the signatories (BitMEX partners) can authorise withdrawal.

They also use an external service to verify that all deposit addresses that are created on the system are those that are controlled by the founders. If they do not then all trading is halted.

For personal security, you have two-factor authentication should you want to make use of it. The hand-processed withdrawals is an extra layer of security should your account be compromised at any time.

System

The server infrastructure is secured by Amazon Web Services. They require multiple forms of authentication as well as hardware tokens.

Trading Engine

Apart from the threat that comes from external attackers, there is also a great deal of risk in running such a highly levered and voluminous trading platform.

This is why BitMEX has a number of policies in place in order to make sure that all of the orders are indeed matched. They run a risk check after any movement on the exchange and the moment that there is any discrepancy, trading is shut down.

Communication

For those traders who are extra cautious about their communication security, BitMEX offers the option to PGP encrypt the automated emails.

If this is something that you would like to do, then you will have to go to your account and insert your PGP public key into the form they present. Once this is completed, all emails that come from [email protected] will be encrypted.

Proof of Reserves

Given what has happened with FTX recently, exchanges are scrambling to prove that client funds are secure, safe, and that the companies are fully solvent. BitMEX is one of the early adopters of Proof-of-Reserves, the trending topic of the day.

According to Glassnode, Proof of Reserves (PoR) displays the assets held on-chain and matching liabilities held both on and off-chain. A number of exchanges have disclosed their on-chain addresses (but not liabilities) to Glassnode, including BitMEX.

As early as Aug 2021, BitMEX investigated the feasibility of adopting PoR as part of their security measures. In a blog from around that time, not only were they considering PoR but also Proof of Liabilities. The idea is that when Proof of Reserves are greater than Proof of Liabilities, this means the exchange is solvent, ie able to process all withdrawals from clients if requested.

BitMEX also uses the Merkle Tree approach for its PoR scheme. Initially, it made the case for only publishing part of the tree in order to ensure anonymity with the user’s information. However, they then argued in their blog that “this makes the Merkle tree structure pointless and the exchange should use the list approach, however, adopting the tree provides flexibility, should the exchange wish to cease publication of the full list at some point.”

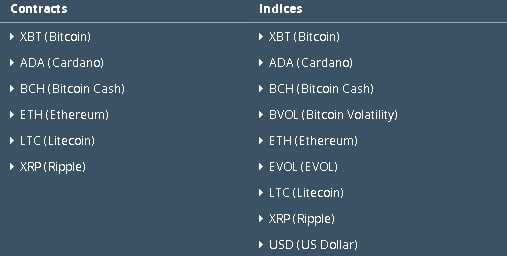

Crypto Asset Coverage

Given that BitMEX is a futures exchange, the only asset that you can trade in the spot market is Bitcoin. This is why when you take a look at the volume on Coinmarketcap, you will only see a figure for Bitcoin.

However, when it comes to the futures markets, BitMEX allows for you to trade 10 different cryptocurrency assets. These are given below:

Bitcoin (BTC), Dash (DASH), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), Monero (XMR), Ripple (XRP), Tezos (TEZ), Zcash (ZEC) and Cardano (ADA).

Although BitMEX supports fewer coins than the likes of Bittrex and Poloniex, these are cryptocurrency margin trades and not the purchase of physical coins. It could be much harder to find the liquidity for the smaller-cap altcoin futures.

Perpetual Swaps vs. Futures

BitMEX has two types of derivative assets that you can trade. These are an instrument termed a “Perpetual Swap” and the plain vanilla futures.

What is a perpetual swap?

A perpetual swap is, quite simply, a future that does not have an expiry date. For those who do not know, futures are instruments that are settled sometime in the future. These are mostly settled every quarter and usually have an expiry price above the current spot.

A perpetual swap will merely be a future that is continually marked to market on a daily basis. In this manner, you can think of a perpetual swap in much the same way as spread betting or a Contract for Difference (CFD) works.

Trading a perpetual swap is just like trading the physical instrument at spot. The price that will be presented will be the spot price of the asset. Of course, your gains/losses will be magnified due to the leverage.

BitMEX Fees

The trading fees at BitMEX work a little bit different given that you are trading leveraged instruments. You will have “maker” and “taker” fees. These essentially imply whether you are making an order or taking an order.

Basically, when you are a taker, you are matching an order that is already on the order books. You are essentially removing liquidity by taking an order that is already on their books.

In the case of a maker, you are adding liquidity to the order books by placing a limit order that is away from the current price. This would be a buy limit order below the current price or a sell limit order above the current price.

At BitMEX, when you are adding liquidity to their books, they will pay you. This is why they are termed a rebate. BitMEX has a rather simple structure for its fees.

For Tezos and ZCash, the fees are:

- Maker fee (Rebate): 0%

- Taker fee: 0.25%

- Settlement fee: 0.25%

And for all of the other coins:

- Maker fee (Rebate): 0.075%

- Taker fee: 0.025%

- Settlement fee: 0.05%

In the case of hidden orders (more below) the fees that you will encounter differ slightly. When you place your hidden order, you will pay the taker fee until the complete order is done. Then, once it has been executed, you will be given the maker rebate.

When it comes to other fees, you will not have to pay anything to BitMEX to deposit or withdraw your funds. However, they will charge you a minimum network fee for your payments, so it makes sense to keep your transaction in larger tranches.

BitMEX Customer Support

The customer support on BitMEX is reasonable in comparison to other exchanges.

They have 24/7 support through emails and tickets. The feedback from other traders that we have been getting is that they are generally quite responsive and take about an hour or so on average.

Of course, if you are asking a more general question, you are better served to search their knowledge database. This is relatively easy to navigate and it seems that they have indeed covered all of their bases.

BitMEX API

For those traders who like to code their own bots and trading algorithms, BitMEX has a really advanced REST and Websocket API.

In fact, the API is perhaps one of the most complete on the market. Every function that is used on the website is exposed via the API. This will allow the developers a large degree of freedom when it comes to building bots and other applications.

Although the exact specifics of the BitMEX API are beyond the scope of this review, we can give you a high level guide of how to use it.

Websocket API

One of the most popular APIs for developers is the websocket one which makes use of the websocket protocol. It is highly flexible and perhaps the fastest option for those developers who merely want to get live data from the exchange.

Hence, the websocket API would be best for those developers who are building applications that make use of market data from BitMEX. Most of this information can also be accessed from the exchange with no authentication required.

REST API

If you are a developer that wanted to take advantage of the full functionality of the BitMEX API, then you can make use of their REST endpoints. These include a whole host of options, such as order execution or wallet withdrawals. The latter is done without email confirmation, so be very careful with it.

If you are using the REST API, there are rate limits that will apply to your connection. You will be limited to a total of 300 requests per 5-minute period. If you are not logged in then this rate limit is set to 150 per 5 minutes.

Bottom Line

One thing that is clear from this review is that BitMEX is an advanced trading platform and is not for everyone. With BitMEX, you are trading very volatile assets with leverage that can reach up to 100x. This is clearly not the type of trading for those who are new to cryptocurrencies. You also have to be aware of the fact that you are not buying the underlying asset and are entering a derivative trade. This is not the platform that you will use for any sort of “buy and hold”. With that being said, for those traders who are familiar with margin trading and technical studies, then BitMEX is one of the best options.