Ethereum’s price has plateaued for a week with reduced volatility and volume. Ever since the Merger, the ETH price has been trading within a descending trend, forming constant lower highs and lows. The Merge has however failed to induce the required momentum due to which the XRP price remained largely bearish.

However, in the meantime, one key metric is showing a continuing bullish pattern in the coming days. Furthermore, large whales have started accumulating more ETH, which points to further positive momentum.

The ETH price is, presently, at the lowest range in the past 12 months as also the exchange supply. This could be a bullish as well as a bearish case for Ethereum price in the coming days.

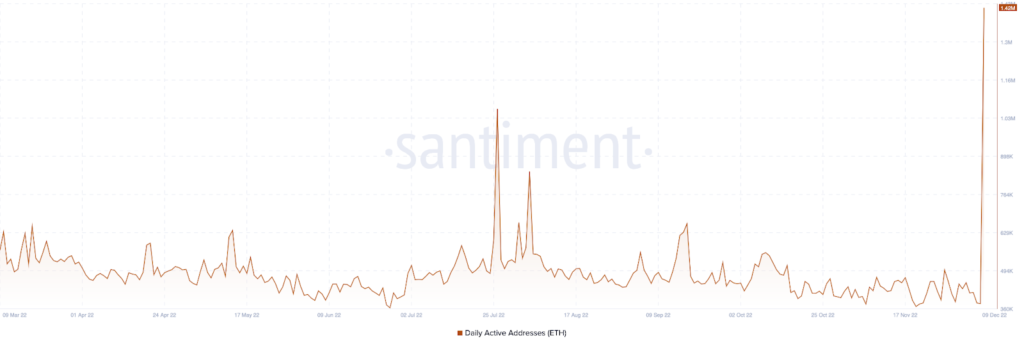

The supply on the exchanges has been declining since October and is on its way to an all-time low. If the supply on the exchanges continues to decline, this could lead to a further drop in prices. On the flip side, falling supply on exchanges is also a bullish sign for ETH, creating more demand which in turn drives the price up. Furthermore, the daily active address has also increased rapidly in the past few days.

The daily active address determines the user activity over the platform regardless of whether they are selling or buying. The addresses rose 378.85K to as high as 1.42M in just a couple of days. Meanwhile, social dominance and development activity has halted its upswing presently. Besides, the total weighted sentiment combines the positive and negative comments and combines with the frequency which has gone positive nowadays.

Therefore, Ethereum (ETH) price has risen somewhat above the bearish captivity and if it sustains at these levels, a notable bull run could be imminent.