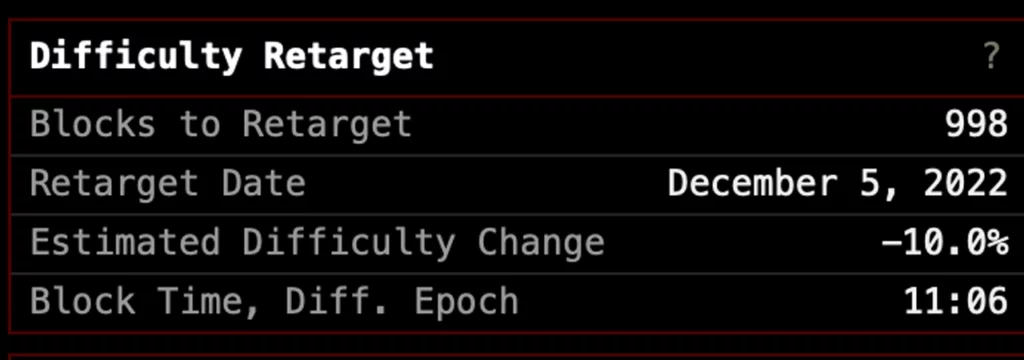

Bitcoin miners could catch a break in a week or so, on or around Dec. 5, 2022, as the next difficulty retarget is expected to see a significantly large reduction. Estimates show the next difficulty retarget could drop anywhere between 6.13% and 10% lower. Presently, the difficulty change looks as though it could be 2022’s largest reduction if it surpasses the 5.01% decline recorded on July 21.

Bitcoin’s Next Difficulty Target Expected to Decrease, Data Suggests a Notable Downside is in the Cards

When the last bitcoin difficulty change occurred on November 20, 2022, at block height 764,064, it was up only 0.51% on the day. However, the increase brought the network’s difficulty to its lifetime high of 36.95 trillion. Since then, during the past week, the average hash rate of the network has been around 249.1 exahashes per second (EH/s).

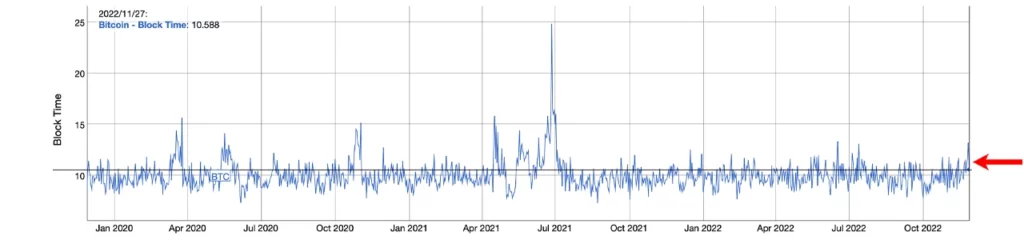

The average Bitcoin network block time has been slower than usual as well, running between 10.2 minutes to 11.06 minutes on Monday evening (ET). The block intervals have been a lot higher since the difficulty change on Nov. 20, as prior to that day, block times had been on average less than ten minutes since Sept. 29.

The longer block times suggest that the 2,016 blocks mined before the next retarget will be slower than an average of two weeks. At the time of writing, data suggests that the retarget could drop as low as 10% on December 5th, with metrics from Btc.com indicating that the decline is estimated to be around 6.13%.

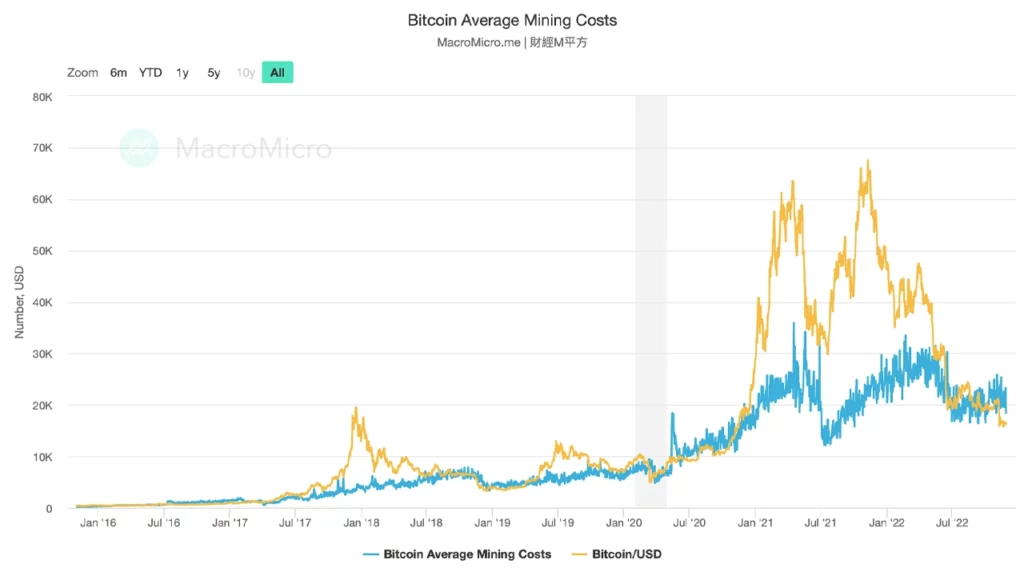

Both estimates would outpace the largest difficulty contraction the Bitcoin network has seen all year with the largest decrease so far recorded on July 21, which was approximately -5.01%. Miners are currently dealing with the highest difficulty ever recorded, and bitcoin (BTC) prices are 76% lower than the all-time high ($69K) recorded on Nov. 10, 2021.

Mining insights from Brains.com and macromicro.me show that the production cost of BTC ($18,360) is higher than the current spot market price ($16,250). Additionally, market intelligence from Glassnode indicates that bitcoin miners are tapping into their coffers.

The onchain analytics firm Glassnode tweeted about how the bitcoin mining sector and industry is “under immense financial stress,” while announcing a mining report the firm published with Cryptoslate.

“What we find is [bitcoin] Miners are distributing about 135% of the coins mined,” said Glassnode. “This means miners are dipping into their 78K [bitcoin] Strong Treasures. During the second half of the year, publicly listed mining operations disclosed that they were selling BTC to increase cash reserves and pay off debt.

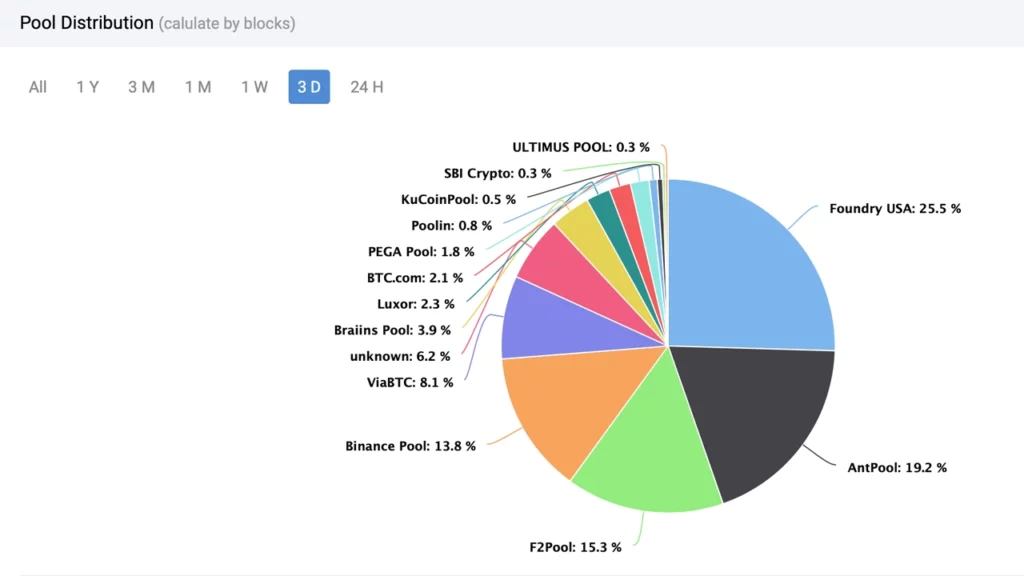

At the time of writing at 7:30 p.m. (ET), Foundry USA’s three-day hashrate is around 60.66 EH/s, which represents 25.45% of the global hashrate. In three days, the largest mining pool Foundry mined 98 BTC blocks out of 385 discovered by all the miners.

Foundry’s hash rate is followed by AntPool, F2Pool, Binance Pool and ViaBTC respectively. Across all five pools in the last three days, the top five mining pools were able to find 315 blocks out of a total of 385.