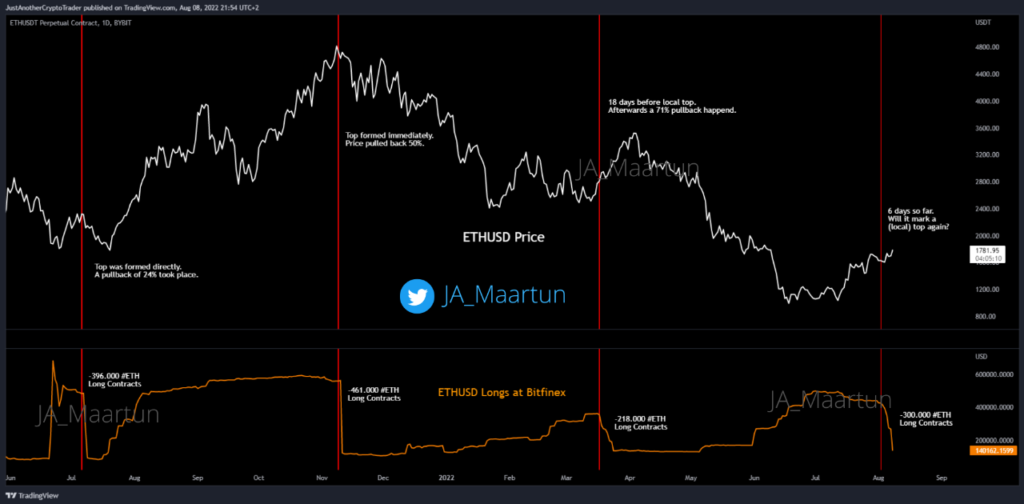

A well-known analyst at CryptoQuant reveals that, judging by the total number of long positions held by ETHUSD on the Bitfinex crypto exchange, the current Ethereum price will turn out to be a bearish one.

Whenever this indicator shines higher, it indicates bullish sentiment among investors. On the other hand, low volume indicates that investors on the exchange do not see an asset price rise anytime soon.

The chart below depicts last year’s ETHUSD long positions held on the bitfinex exchange.

After falling below its investor cost base for the first time since March 2020, bitcoin has recaptured important support areas and is selling beyond its market cost basis.

Ethereum Price To Plunge?

Whenever Bitfinex has experienced a drop in the Ethereum long positions, the currency’s value has also been affected negatively. Currently, the long positions have witnessed a drastic fall with nearly 300k being shut.

Up until this moment, Ethereum was performing very well, with the upcoming merger affecting it in a positive way. However, if the pattern is to repeat, Ethereum price could bounce back in the next 12 days.

At the time of publication, the Ethereum price is trading at $1,695 after a downfall of 1.53% over the last 24hrs. The chart below shows the performance of Ethereum over the past 5 days.