Ethereum [ETH] balances on exchanges reached a four-year low in what could have been termed a surprise. According to data from the leading analytics platform, Glassnode, the total number of ETH held on exchanges remained under 20 million. Glassnode recorded this number in the late hours of Friday, 22 July.

The last time ETH had such exchange balances was in July 2018. During the period, ETH exchange balances were around 19.93 million. Following this event, investors could prepare for the Ethereum 2.0 network upgrade. Also, the evocation by Vitalik Buterin of the possibility of 100,000 transactions per second after the merger could have influenced the action of investors. However, it’s not just that. The reductions in the foreign exchange balance were also accompanied by something else.

Over and out

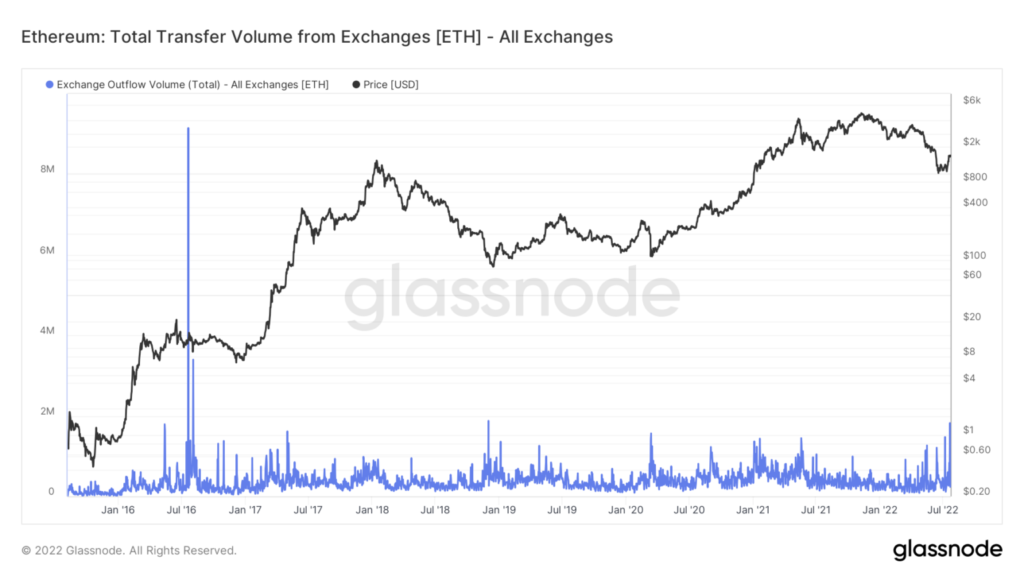

Similarly, the exchange outflow volume of the Ethereum chain has been massive over the past few days. The metric hit a 13-month All-Time high (ATH). At press time, it was 602.618— a figure it had not reached since June 2021.

This action further proves the hypothesis that investors do not plan to hold their ETH on centralized exchanges as the launch of Consensus Layer approaches. So how has this affected the price movement of ETH?

Action meets preparedness

While the ETH trading volume had increased 2.98% over the last 24 hours, its price had dipped slightly. After trading as high as $1,638 on 22 July as per CoinMarketCap, ETH has now left the $1,600 zone. At the time of this writing, the ETH price traded at $1,580.

Besides this price drop, what else has happened to ETH?

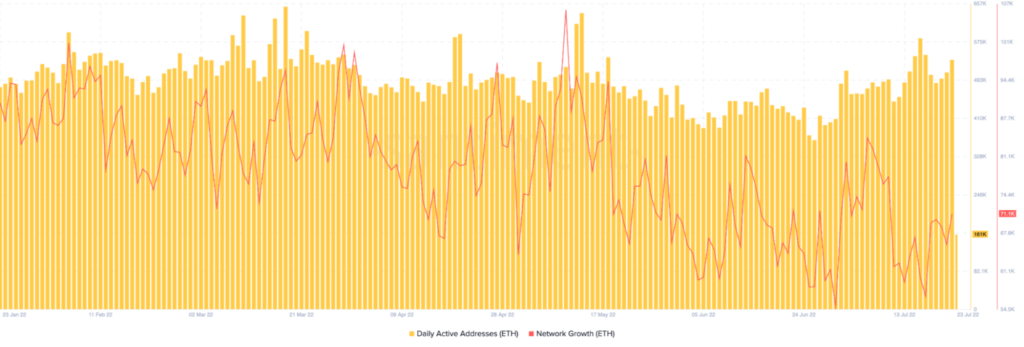

A look at Santiment data showed that the daily active ETH addresses had increased. As of 19 July, it was 487,070. However, it had surged to 536,750 at press time. The network activity had also increased from 17 July till today (23 July).

On the daily four-hour chart, it looks like ETH still has the potential increase from its current price. The Directional Movement Index (DMI) revealed that the buyers may have the edge. However, the -DMI (red) line looks remarkably close to meeting the +DMI (green), showing that bearish sentiment is also possible.

Additionally, the Relative Strength Index (RSI) maintained some neutrality, swinging between 56 and 57 regions. However, it still provides an edge for buyers. With this, ETH price movement might be yet undecided. However, more investor action could be the game changer that sets it in a specific direction.