Dealing with the constant selling pressure hasn’t been easy for any altcoin. Well, not even for the king alt Ethereum. ETH has been following the broader market cues. In fact, the past week registered around 10% gains but a weekend sell-off saw ETH’s prices cut by more than 3%.

A hidden gem?

Ethereum continues to show mixed signals on the network. According to Santiment, the average transaction fee on Ethereum has dropped to $0.88. This is the lowest value seen on the network since July 2020. The drop in transaction fees on Ethereum is the result of prices dropping 75% since November, which has drastically reduced usage.

Gas fees have been a source of concern in the Ethereum community. However, the current state of fees shouldn’t be a positive signal for the community.

Well, the drop in demand for Ethereum in the market in different sectors such as NFTs shows a declining volume. And, a lack of volume is about decreasing activity on the network, which in itself is a concern.

That being said, as per reports from Glassnode, the total value in the ETH 2.0 deposits reached an all-time high of 13,018,325 ETH. As we edge closer to the Merge, investors are increasing and are continuing to deposit their holdings in the staking contracts.

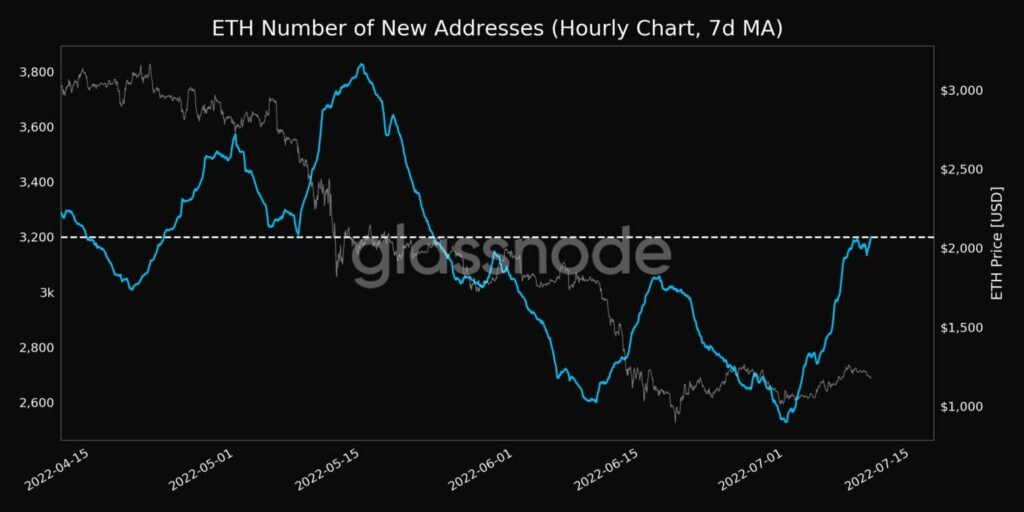

Additionally, the number of new addresses (7d MA) hit a 1-month high of 3,199 on July 10. This should give the community a boost as it hints at the growing strength of the network.

Also, over the past week, around $650 million worth of ETH was taken out of exchanges. This serves as a huge turnaround for ETH investors as exchange outflows continue to indicate resilience from holders.

What about ETH now?

According to reports, the total locked value of Ethereum DeFi fell from $59.42 billion (Q1 2022) to $34.21 billion (Q2 2022) – a decline of 42.4%.

ETH was trading just below the $1,150 mark, at press time, after a major downward turn on 10 July. However, it has been able to recover 6.78% of its position over the past week.

Top of Form