stETH is a token representing staked Ether in the Lido Finance platform, combining the value of an initial deposit + staking rewards. A derivative token backed 1:1 by ETH. Users who stake their ETH on the Lido Finance platform receive the staked derivative in return.

Users/stakers can access the value of their staked tokens when they are staked. But what about its potential downside?

Landslide in play

Lido’s staked ETH (stETH) token price has dropped to a 5% discount against Ether (ETH) for the second time in a month, amid fears of shrinking liquidity for the staking derivative.

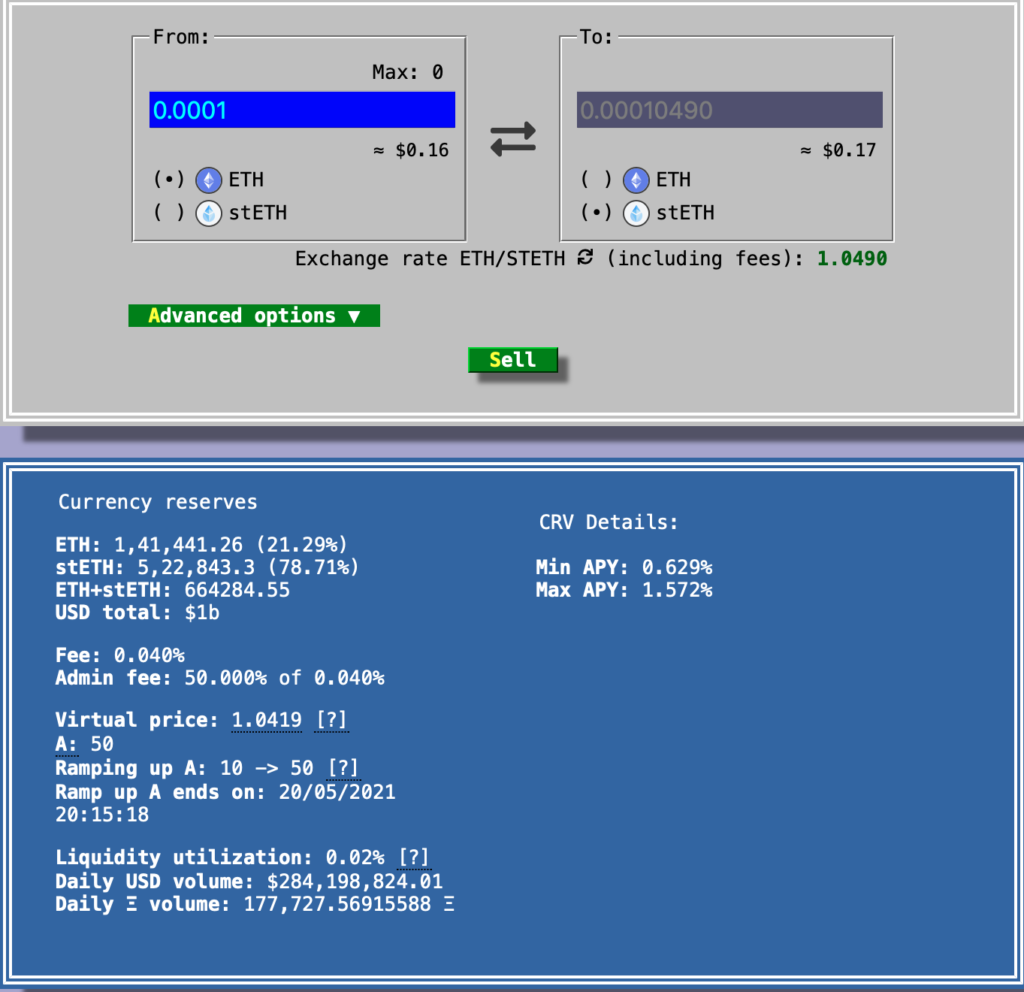

Token holders can sell their stETH for ETH on the open market. But what if liquidity continues to fall? This is exactly the case here. Due to the large sales volume, the pool has become unbalanced. This is the case with Curve, the leading DeFi liquidity pool. It now has a ratio of 22% ETH to 78% stETH at press time. It’s the most unbalanced pool the pool has ever been.

The unbalanced pool signified one of the assets, stETH in this case, is becoming more illiquid i.e. it would become difficult to sell as there isn’t enough ETH liquidity to incorporate sell orders of stETH at current prices.

According to Curve, the current asset ratio of the stETH/ETH pool is skewed, with ETH representing 24.11% and stETH representing 75.89%. stETH stalled slightly.

In fact, AlamedaResearch exited their position yesterday and unload nearly 50k stETH just in a matter of hours. CelsiusNetwork is quickly running out of liquid funds to pay back their investors who are redeeming positions. Well, sETH suffered a fresh 10% correction to make things from bad to worse for the platform.

But stay calm, right?

Well, that’s what Lido Finance urged to do in this situation via a tweet on June 10.

Furthermore, the past month has witnessed a number of events have worked to destabilize the stETH:ETH exchange rate, including the Terra collapse, market-wide deleveraging, and now withdrawals from larger lending platforms.