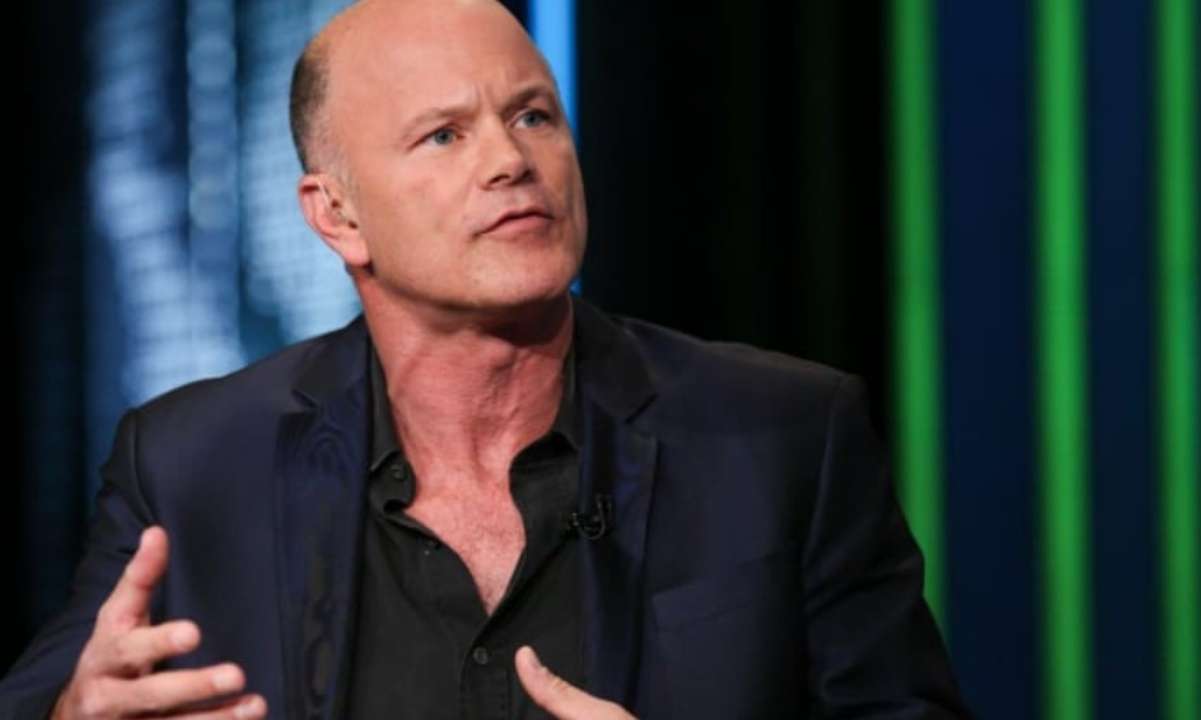

CEO of crypto investment firm Galaxy Digital and former hedge fund manager, Mike Novogratz, stated that two-thirds of the crypto hedge funds will fail as a result of the sharp downtown this year in the price of these assets.

The future of the crypto hedge fund

Speaking at the Piper Sandler Global Exchanges & Brokerage conference in New York, Novogratz said hedge funds investing in crypto will ultimately have to restructure. The executive also observed that the current state of the crypto market is a consequence of the removal of stimulus by the Fed as well as the fall of Terra which has shaken investor confidence in the space.

“Volume will go down, hedge funds will have to restructure. There are literally 1,900 crypto hedge funds. My guess is two-thirds will go out of business.”

Hedge funds embrace crypto

Novogratz’s comments come at a time when traditional hedge funds are increasingly diving into digital assets. According to PricewaterhouseCoopers (PwC) 4th Annual Global Hedge Funds Report 2022, around one-third of traditional hedge funds surveyed are already investing in Bitcoin and other digital assets. So far, hedge funds have limited their exposure.

In fact, 57% of the hedge funds have allocated less than 1% of their total assets under management (AUM). Around 67% of those surveyed and currently investing in the market intend to deploy more capital into the asset class by the year-end. Even those hedge funds not yet investing in crypto confirmed that they are in late-stage planning to invest or looking to do so.

While regulatory and tax uncertainty continues to remain a constant barrier to adoption, lack of infrastructure and availability of service providers is another challenge that many hedge funds face in actively participating.

Mike Novogratz and Terra Collapse

The crypto bull has also been criticized for his role in the Terra ecosystem. Interestingly, he had not only invested in LUNC (formerly LUNA) but even got a tattoo. Galaxy Digital had invested in the Terra ecosystem since September 2020, long before the token cracked the top 10.

The Terra crash didn’t hurt Galaxy much because the company not only diversified its portfolio, but frequently took profits rather than letting it all roll, leveraged a risk management framework, and recognized that its investment would be affected by macroeconomic events. He went on to say that the event was a learning opportunity for many in the industry.