Bitcoin (BTC) price is expected to hit a “cycle bottom” this year, with a decline of nearly 50% from present levels, according to research.

On June 1, Venturefounder, a contributor to on-chain analytics platform CryptoQuant, predicted that Bitcoin will “capitulate” around 2022 in a Twitter conversation.

The year 2022 looks like bearish black sheep, according to historical trends regarding Bitcoin’s halving cycles, Venturefounder stated.

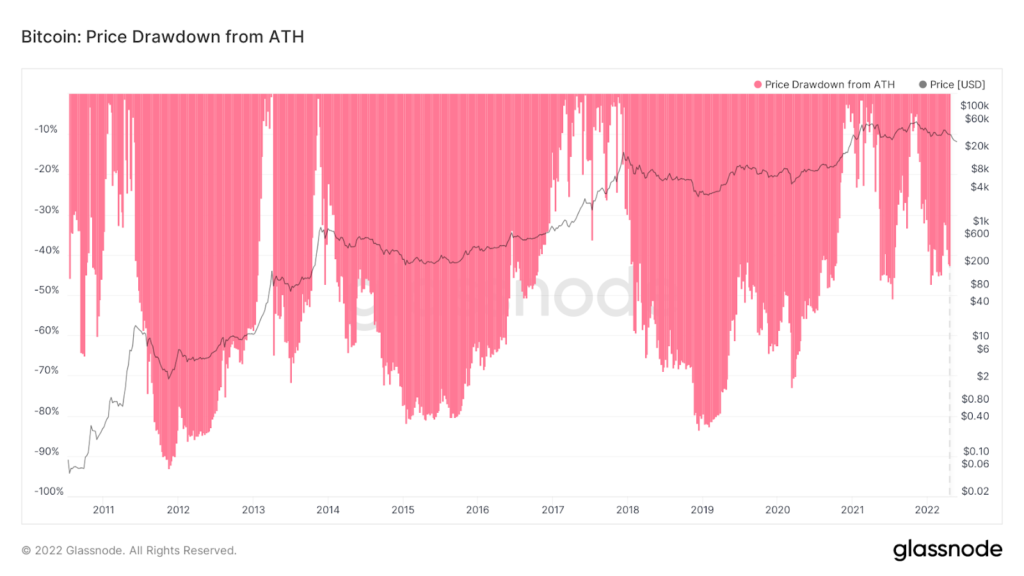

BTC/USD is expected to find a macro floor in 2022, similar to 2018 and its bear market. Based on past falls from all-time highs, this may be in the range of $14,000-$21,000.

“We are still on time to BTC performance compared to previous cycles with 670 days till the next Bitcoin halving,” one tweet explained:

BTC will succumb in the next 670 days and bottom out ($14-21,000), then rebound in the $28-40,000 range for the rest of 2023, and back to $40,000 by the next halving .

While such a prediction would not be pleasing to bulls’ ears, it would not be unusual. Bitcoin price recovered from its December 2018 low of $3,100 to $13,800 seven months before reverting backwards again to bottom around $3,600 in March 2020.

Indeed, the local peak of 2019 could not exceed the previous high of $20,000 reached in December 2017.

That level, according to Venturefounder, might reappear on the spot price chart. Even now, those who are able to start the tide and invest will be on the correct track.

“On the contrary, buying Bitcoin in the next 6-12 months is close to perfect.” He went on to say, “Probably the best 3-year ROI ever.”

Bitcoin Price Forecast Foresee Bottom

Others, though, have pegged the possible bottom area around $14,000 or close to it.

That would be a nearly 80% loss from the current all-time high of $69,000, which matches the low of the previous cycle in percentage terms.

According to Glassnode data, an on-chain analytics firm, current levels around $31,000 indicate a rather small decline.

Rekt Capital, a crypto analyst, has forecast a possible target of $15,500 if BTC/USD drops below its 200-week moving average last month.

Traders may find it tough to push the economy that low. MicroStrategy, which controls the biggest BTC assets, recently stated that it will buy into any BTC cascade approaching the $20,000 threshold.

Former BitMEX trading company CEO Arthur Hayes also said he would invest in BTC at a price of $20,000.