Ethereum, the largest altcoin continues to suffer the bearish winter within the crypto market. ETH slipped below the $2k mark following aggressive sell-offs from traders/investors. The number of addresses in loss reached an ATH of 34,966,535 as per Glassnode. Thus, showcasing the reason behind the event.

However, the altcoin has another trick up its sleeve – something that ETH has relied on.

Smile through the pain

For starters, “The Merge” refers to the long-awaited Ethereum blockchain upgrade. The second cryptocurrency would transition to a proof-of-stake model, a change that should eliminate concerns about Ethereum’s environmental impact. Likewise, improve its transaction speed.

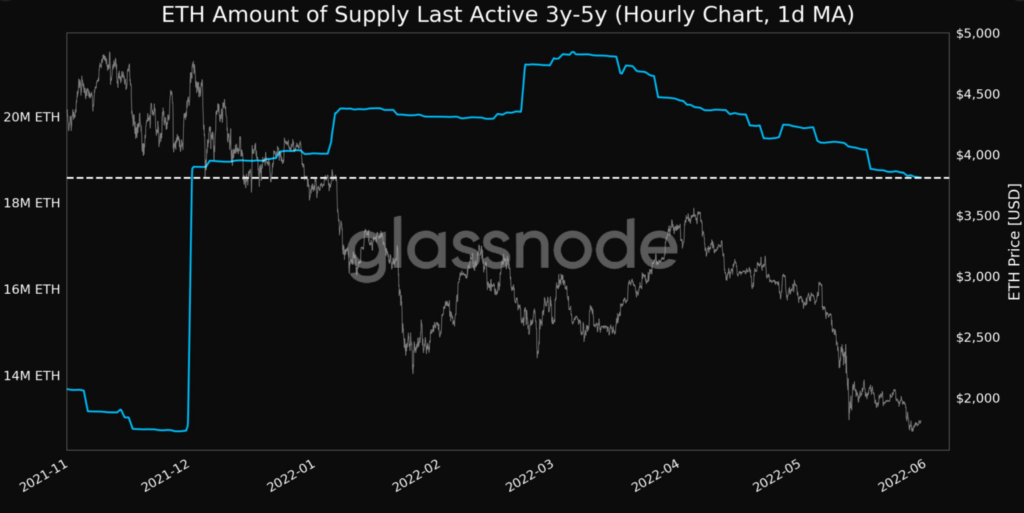

To achieve the ‘deflationary’ status, and in line with the Merge, the said cryptocurrency kept destroying a portion of its own supply. In fact, the amount of supply last active 3y-5y reached a 5-month low of 18,579,468.002 ETH.

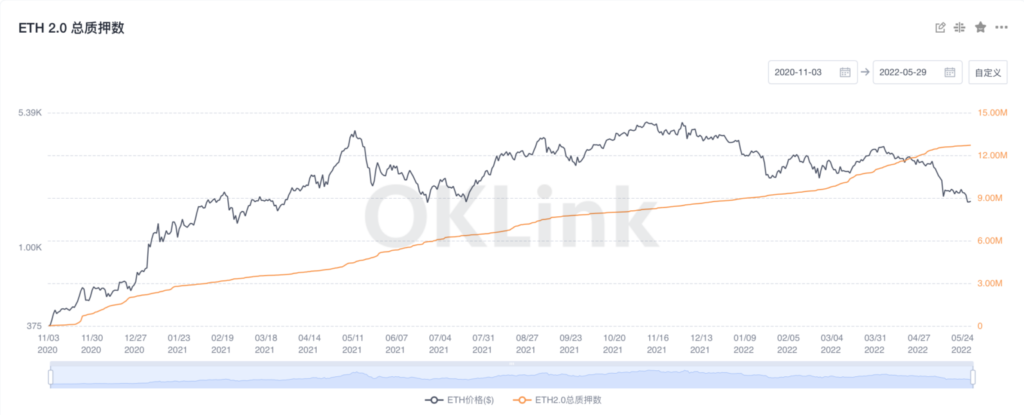

Merging in transit has done the larger altcoin network a huge service. As the Ethereum network accelerates the transition to ETH 2.0, investors have prepared for the staking feature by continuing to deposit Ether.

As of 30 May, the latest stats recorded an impressive figure. The number of staking ETH 2.0 deposit contract addresses reached 12,711,363, and the staking rate has reached 10.72%. This means more than 10.72% of the ETH, currently in circulation is deposited in ETH2.

Additionally, Ethereum network fees, at the time of writing, were the cheapest in over ten months. Average ETH transfer fees have dropped to a low of $2.96 per transaction.

The aforementioned factors could, indeed, help the flagship coin register a short rally soon. In fact, at press time, ETH did witness an 8% surge that aided ETH in crossing the $1.9k mark.

The question remains unanswered

The ambitious change of ETH encountered different obstacles in terms of delays over the months. Recently, it experienced a high-level security risk known as the blockchain “reorganization”. To make matters worse, no definitive date has been released for the “long-awaited” upgrade.

The question remains, until when can ETH depend on this “anticipation” to register some gains?