It is definitely a crypto bear market when the mainstream media is awash with catastrophic price crash predictions such as the most recent one for bitcoin from Guggenheim’s Scott Minerd.

Guggenheim Partners Chief Investment Officer Scott Minerd is back with his bearish predictions saying bitcoin prices could drop as low as $8,000, a level he hasn’t seen in two years.

Not only did he suggest that BTC will crash that hard, but he also said that the current market has become a “bunch of yahoos,” presumably in reference to the Terra ecosystem fiasco. The comments came during Bloomberg Television interview from the World Economic Forum in Davos.

The cryptographic derision continued with him stating “everything is suspicious” before adding:

“No one has cracked the crypto paradigm. We have 19,000 digital currencies…most of them are junk.

The comments mark a complete U-turn from Minerd who just last year said that a fair value for BTC would be $400,000 to $600,000.

Guggenheim bought bitcoin at around $20,000 and sold it at $40,000 according to the report which added that the company no longer holds any assets.

An unlikely scenario

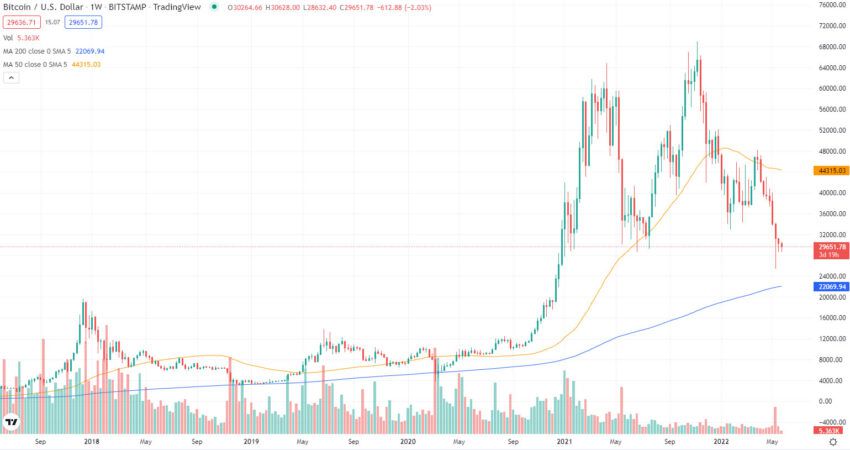

History usually rhymes with crypto market cycles and the previous two have seen corrections of just over 80% from cycle peak to bear market trough. If history rhymes with the current cycle, bitcoin prices could realistically fall to around $12K to $14K following a correction of similar magnitude.

Minerd’s bleak outlook would be a correction of over 88%, which has not happened in the previous two market cycles. The last peak-to-trough drop was 84% in 2018, just like the one in 2014.

Such a dramatic fall would mean that major corporate holders of bitcoin such as MicroStrategy and Tesla selling their stashes at a massive loss. Between them, they hold 172,418 BTC worth more than $5 billion according to Bitcoin Treasuries. It could also occur if El Salvador started liquidating its BTC treasury at a loss.

This is unlikely to happen as these entities strongly believe in the asset and are likely to hold it and even accumulate more in anticipation of the next bull cycle. Selling at a loss would not be a smart move on the part of a CEO or President.

More pain for bitcoin

The current correction stands at 57% as BTC has just dropped below $30K once again on Wednesday and has failed to reclaim it during the Thursday morning Asian trading session.

A major support level, which has been held in previous bearish cycles, is the 200-week moving average. It is currently at the $22,000 price level according to Tradingview, which could be where things are heading in the next two months. However, a decline in this technical indicator would be a 68% correction.