According to Bitcoin derivatives, the spot asset may rally quite soon, Bloomberg suggests

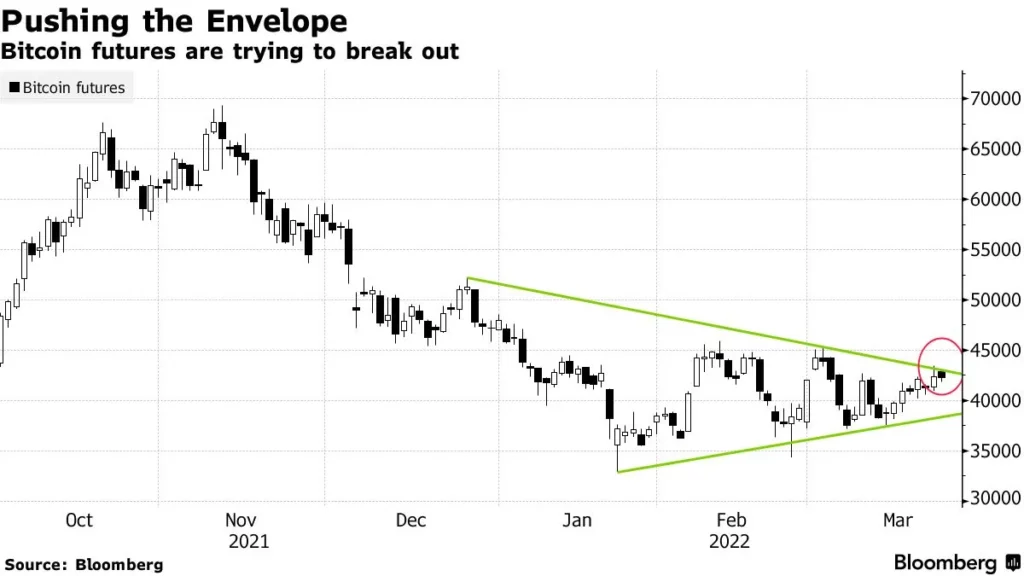

According to Bloomberg analysts, Bitcoin futures are poised to rally as traditional financial markets have shown strength in recent days. As analysts suggest, they expect an increase in open interest and a breakout of the triangle pattern, which will positively affect the price of the spot asset.

Breaking through the pattern

The symmetrical triangle on the Bitcoin charts was one of the main points for the whole market, as the spot trading pair touched both sides of the pattern numerous times in the last three months.

The more local version of the same ascending range of pattern could give us more clues about the previous and current movements of the first cryptocurrency. According to him, Bitcoin is still going even after touching the bottom of the pattern at least three times.

Previously, the market was expecting a breakthrough after digital gold reached the resistance of the rangebound at $45,200. But because of the absence of significant buying power, Bitcoin failed to break above $45,000 and tumbled down to $37,925.

Open interest up

Another factor that speaks in favor of digital gold is the global increase in open interest in derivative assets, which suggests that the market is getting “live” and traders are opening more positions than before.

The final signal toward the normalization of the market structure would be given after the first cryptocurrency breaks from the consolidation range and enters a new uptrend, which is already expected by industry experts like Willy Woo.

Previously, top on-chain analysts said that the nature of bitcoin market cycles had completely changed and we would not see the traditional “four-year halving cycles.”