Terra (LUNA) has printed a bullish signal on its daily chart

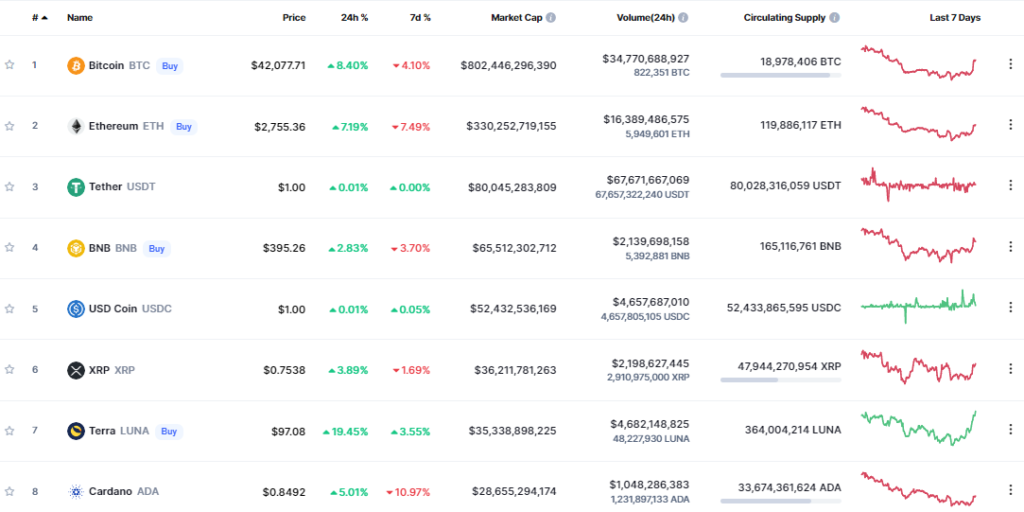

As seen on CoinMarketCap, Terra (LUNA) remains a top 10 cryptocurrency player, having gained over 30% in the last 48 hours. Terra saw a significant price gain after finding support at $75.60 on March 7. LUNA then rose to highs of $98.80 on March 9 as it prepares to mark the second straight day in the green.

The price gain led to an increase in Terra’s market capitalization, causing it to flip Solana and Cardano to grab the seventh spot, per CoinMarketCap data. U.Today previously reported that Terra (LUNA) printed a bullish signal on its daily chart. According to a prominent crypto analyst, the next upside target for LUNA might be $112 or even $120.

The latest price increase follows strong fundamentals and positive sentiment for Terra.

Per Staking Rewards data, Terra is the largest staked asset among all major cryptocurrencies in terms of total value staked, likewise in terms of TVL (total value locked), outpacing Solana, Ethereum and Cardano. Presently, more than $31.4 billion in LUNA have been staked directly on multiple platforms. Annual yields for participants are over 6.13%.

Terra also currently ranks the second largest smart contract platform by total value locked, after Ethereum, according to data provided by DeFi Llama. With a current total value locked (TVL) of $25.65 billion, Terra ranks ahead of Binance Smart Chain, Avalanche, and Fantom.

Cryptomarket rebounds

Bitcoin and other cryptocurrencies surged after the U.S. Treasury reportedly disclosed details of an impending executive order. The Treasury statement was quickly retracted after it was released, but it was widely regarded as positive for the cryptocurrency sector. Traders are still waiting for the final executive order, but a brief Treasury statement that appeared to be pro-crypto was enough to raise confidence.

The executive order, according to Cameron Winklevossco-founder of cryptocurrency exchange Gemini, is a “constructive approach to thoughtful crypto regulation.”

According to data from CoinMarketCap, Bitcoin was trading at $42,019, up roughly 9%. Other cryptocurrencies, such as Ethereum, also rose sharply.