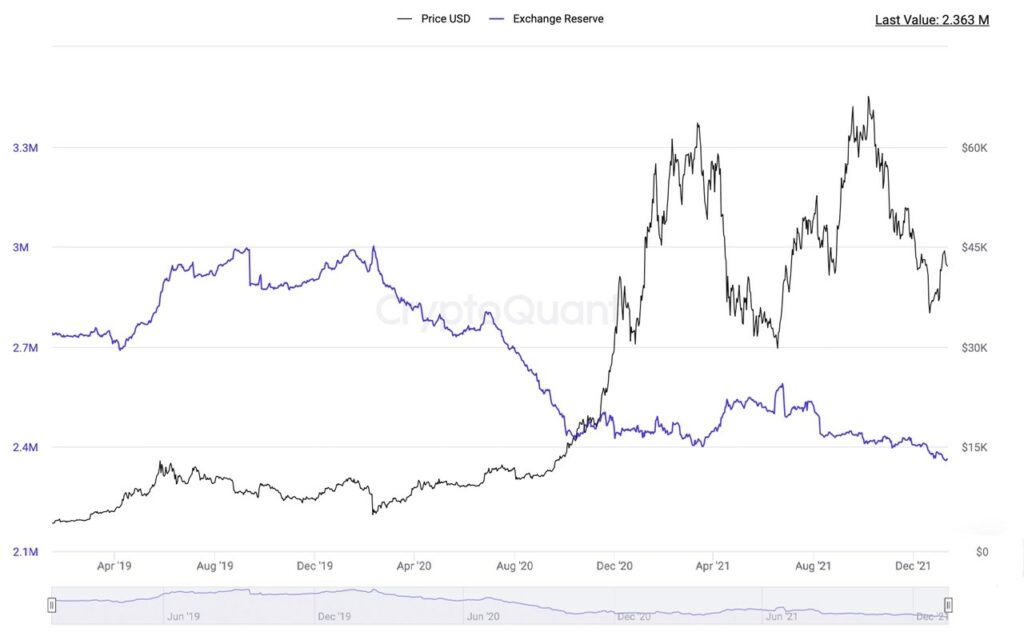

While the price of bitcoin is 38% lower than its $69K price high three months ago, the amount of bitcoin on exchanges is at its lowest figure since April 2021. At the end of July last year, there was 2.59 million bitcoin held by crypto trading platforms, and today there’s only 2.36 million held by exchanges, which means there’s 8.8% fewer bitcoin on exchanges than six months ago.

Bitcoin exchange reserves drop 8% from bitcoin held on exchanges 6 months ago

According to current statistics, there are 2.363 million bitcoins, or $100 billion, of the top crypto asset held on exchanges. The current value of bitcoin (BTC) held by centralized exchanges is equivalent to 12.36% of the $809 billion global market capitalization of BTC.

While 2.363 million is a significant fraction, it’s 8.88% less than the number of bitcoins held on exchanges on July 25, 2021. Too many crypto market participants, and the fact that there’s less BTC on exchanges means less selling pressure going forward.

The metrics indicate that the last time bitcoin exchange reserves were this low was ten months ago, in April 2021. Combined statistics from Bituniverse, Peckshield, Etherscan and Chain.info show that the Coinbase exchange holds the most bitcoins (BTC) today with 853,530 BTC held in reserves.

The value of Coinbase’s BTC holdings equates to 35% of the current $100 billion worth of BTC held on exchanges. Binance is the second-largest bitcoin holder, in terms of exchanges, with 339,870 BTC worth $14.5 billion using current bitcoin exchange rates.

Ethereum Exchange Reserves Drop, Miners Sell Holdings

Meanwhile, the same can be said for the number of Ethereum (ETH) held on centralized exchanges. Data from cryptoquant.com shows that there are 17 million ether held on exchanges today, but that amount has dropped significantly since May 2021. In May last year, crypto exchanges held 21.9 million ethereum.

This means roughly 22.37% of the ETH held on exchanges has left the market environment for alternative solutions. On the other hand, much of the ETH that has left centralized exchanges since last May could have been transferred to decentralized exchange (dex) platforms.

Currently, the most active crypto exchange by ether trading volume, Binance, holds 3.59 million ETH in reserves. While less BTC and ETH on exchanges could lead to lower selling pressure, metrics show that BTC miners are selling bitcoin.

Miner holdings, according to Glassnode data, went negative on February 5, 2022, for the first time in two months. At the time of writing, cryptoquant.com statistics indicate there’s roughly 1.86 million BTC held by mining entities.