Whales take control of the token as it recovers

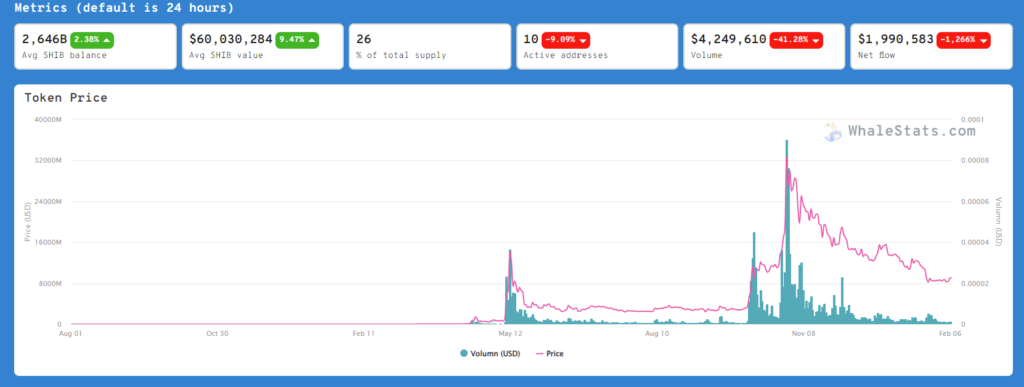

Following the rally in the altcoin market, Shiba Inu and other smaller altcoins saw a sudden price increase, with SHIB gaining 7.5% at its daily peak. As retail traders buy the asset, the whales that control 26% of the supply face $100 million in profits.

Whales control the meme-related token

According to data from WhaleStats, whales currently control 26% of the total supply. Exchange-related addresses and companies are not being counted by the tracker, which allows for determining the true percentage of large owners on-chain.

With the increasing number of whales, assets tend to lose the previous volatility that was present when nearly 100% of all traders in the market were short-term speculators. As the composition of owners suggests, Shiba Inu is currently considered a mid-term asset, with the majority of owners having entered the asset at least six months ago.

Whenever whales take control over the asset, its correction tends to stop as large wallets are continuously accumulating the token or coin instead of selling it. Large selling volumes usually appear at the end of bullish rallies, where retail buying power exceeds unrealized losses that then turn into unrealized profits.

The whale hoarding of Shiba Inu began when the token lost nearly 30% of its value within days of hitting the all-time high in October. Whales bought up to $300 million worth of SHIB in a matter of days.

Unfortunately for them, SHIB has failed to deliver any type of rebound on the market, leaving the majority of investors with a 40-60% loss.