The recent unexpected price action in the market has resulted in positive shifts in sentiment. However, many analysts remained skeptical due to macro-level uncertainty.

Here, we discuss the important technical confirmations for a mid-term trend reversal and investigate the holders’behavior during the recent price downfall to $32.9K.

Technical analysis

Long term

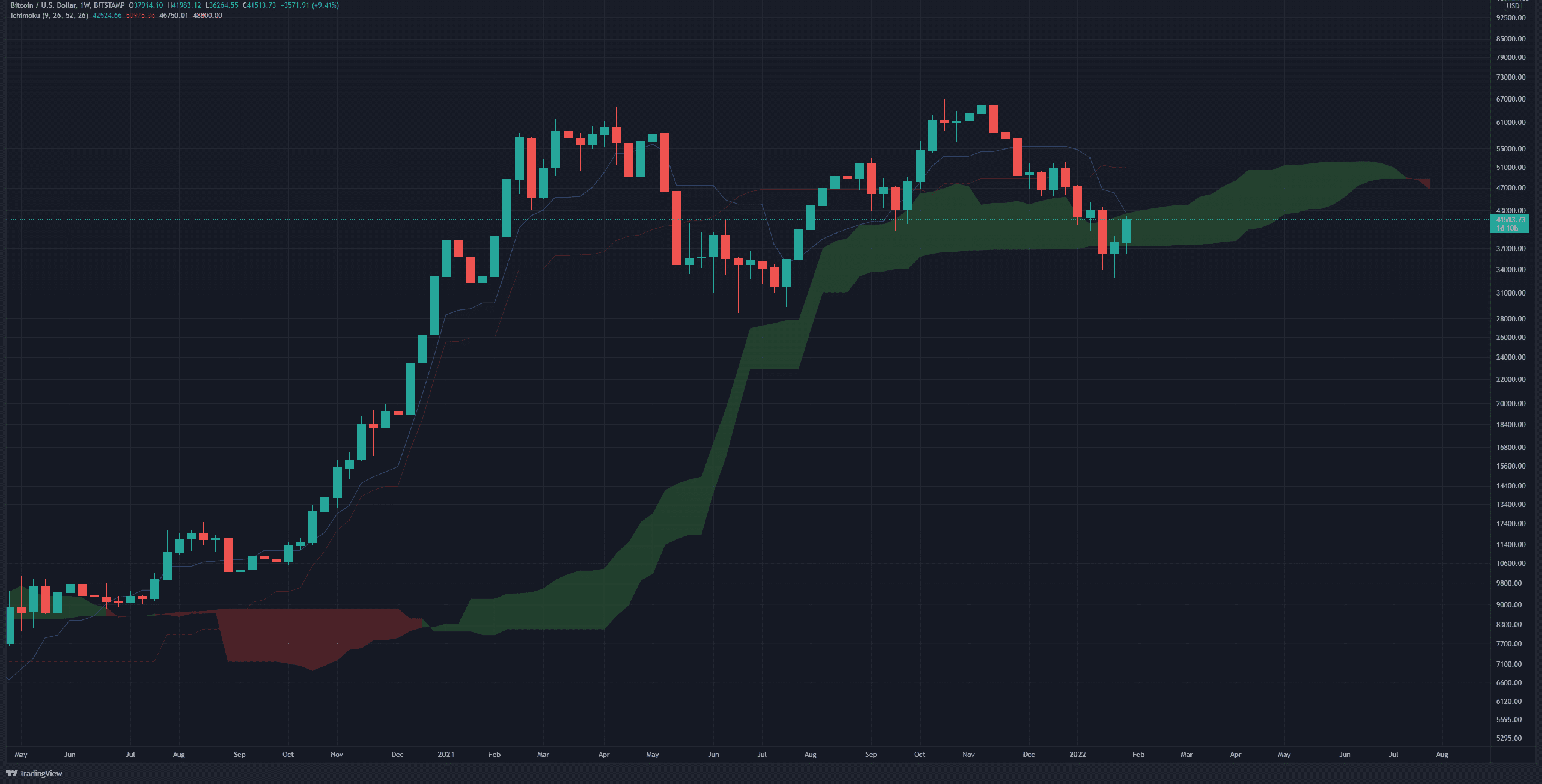

Most technical analysts believe that price consolidation below the weekly Ichimoku cloud is the end of bitcoin’s bull run, or it won’t be easy to get back to higher levels in the near term. A weekly candlestick closed below the cloud two weeks ago. But then the uptrend started which did not allow the price to stay under the cloud any longer.

Therefore the uncertainty about the positive momentum is not over yet. At the moment, the price is struggling with the Kijensen, which frequently plays as resistance. Nevertheless, crossing above this dynamic resistance (~$43K) can send a positive signal to technical traders/analysts in the market.

Short term:

On the 4 hour time frame, the intersection of the dynamic resistance (marked by the yellow line) and the POC line (highlighted by the red line) is of interest. Recent candlesticks show weakness in the unexpected uptrend that started the day before. Bears tend to dampen upward moves and bulls support retracted areas. The general rule of thumb is that crossing this area and forming a higher high will usually result in the confirmation of a downtrend reversal.

On-chain analysis:

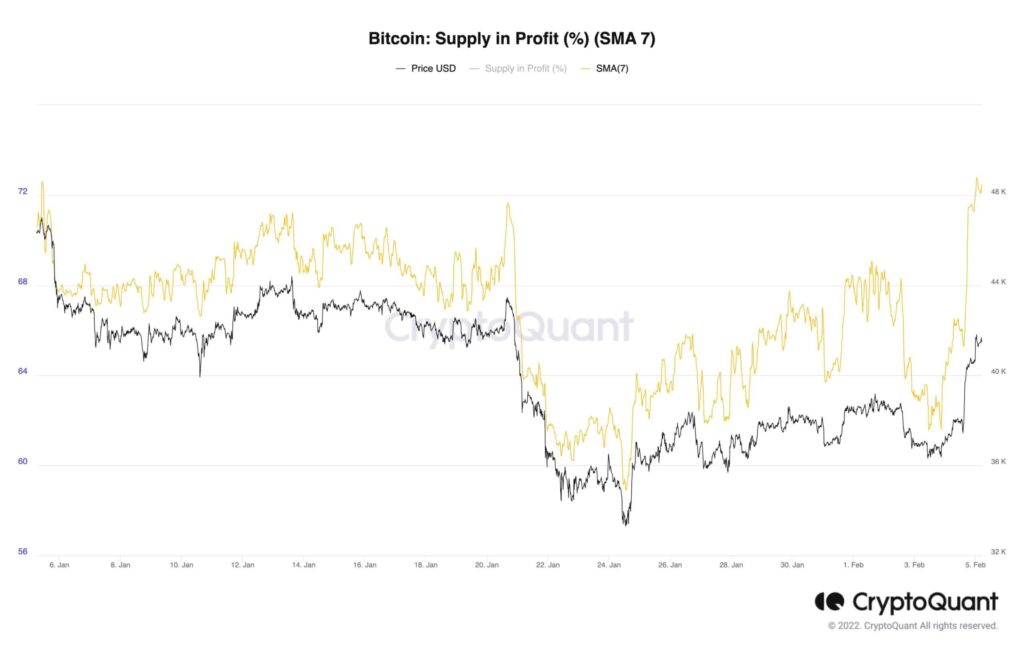

In light of the market structure, it took bitcoin 14 days to recover the $41,300 level. Looking at the percentage of the bid in profit, during this correction to $32.9K, only 6% of the bid changes hands.

This small change in the percentage means the holding incentive has been dominant recently. This observation, compared to many former similar events, can confirm the illiquid supply in the market is unlikely to be deployed to exchanges because of short-term volatility. In other words, the identity of long-term holders, in this cycle, has changed significantly.