Global cryptomarket value rebounds 6% as Bitcoin, SHIB and altcoins seek relief from bears

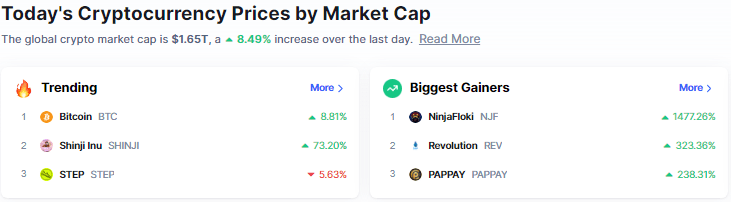

As per CoinMarketCap data, the cryptocurrency market’s total valuation is recovering by nearly 8.49% presently to stand at $1.65 trillion. Bitcoin’s price rose to intraday highs of $36,814 at press time as the entire crypto market stabilized after a broad market correction downward in the past week.

Nearly all altcoins, especially the top 100, were trading in the green at press time with Avalanche (AVAX, +13.01%), Shiba Inu (SHIB, +8.86%), Cosmos (ATOM , +16.15%), Fantom (FTM, +19.99%) and other altcoins adding significant gains.

Bitcoin is currently trading at $36,319 and is up 8.11% in the past 24 hours, according to CoinMarketCap data. At the time of publication, Ethereum was 8.29%, trading at $2,416, while SHIB trades up 8.86% at $0.000021.

On-chain analytics firm Santiment notes that buy calls have consequently increased since the start of the month.

Major stock indices tumbled earlier in the day before rebounding as investors closely watch the Federal Reserve’s first meeting this year, which will take place this week.

The Fed’s Federal Open Market Committee (FOMC) is due to meet on Wednesday, and an interest rate announcement could have immediate ramifications for the traditional and crypto markets.

Stock market correlation

Bitcoin and the crypto market appeared to be following the performance of the stock market recently. The recent crypto market declines coincided with a slide in global stocks. According to experts, major institutional funds’ engagement has caused digital assets to become more linked with traditional markets.

Cryptoanalyst Will Clement noted the ”biggest volume day for the Nasdaq (QQQ) in over 10 years” while highlighting the correlation between Bitcoin and Nasdaq.

The recent market sell-off, according to Luno crypto exchange’s Vijay Ayyar, is more of a “correction” than a persistent decline. He sees $30,000 as a crucial threshold to watch for Bitcoin. “That would definitely indicate high likelihood of a bear market,” he stated, if BTC closes below this level in a week or more.