Bitcoin fell to $ 40,600 as Goldman Sachs announced expectations for the Fed’s interest rate hike this year

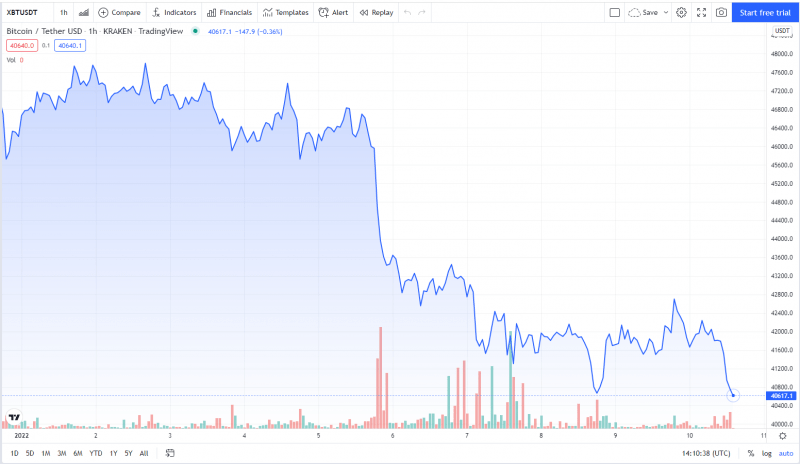

The Bitcoin price has dipped to the $40,600 level on the Kraken exchange as Goldman Sachs has voiced its expectations that the U.S. Federal Reserve may hike interest rates higher than it announced previously.

Bitcoin drops to $ 40,600

According to Bloomberg Terminal, banking giant Goldman Sachs expects the Fed’s interest rate hike to happen not three times but four this year.

On Jan. 6, when Bitcoin plunged from the $46,500 area to the $42,000 zone, U.Today shared three likely reasons for that sudden price drop. The market turbulence after the minutes of the Federal Reserve meeting were released was one of them. The minutes showed that, as early as March of this year, the Fed may raise interest rates.

Bitcoin wasn’t the only asset that responded by giving up. The same goes for the technology-driven Nasdaq Composite Index which is closely correlated with the flagship crypto. The same thing also happened today: NDXT has fallen 2.37% since January 7.

The U.S. Composite Index has dipped 1.4% today too. As Bitcoin keeps falling, the price has reached $40,600 so far.

Bitcoin RSI drops and shows extreme fear

Aside from new expectations for the Fed’s rate hike this year, on January 8, the Bitcoin Fear and Greed Index fell to 10, showing “extreme fear”.

The day before, the Bitcoin RSI (relative strength index) dropped below 30 for the first time since May, showing that Bitcoin at the moment is largely oversold.

Riots in Kazakhstan lower Bitcoin hashrate

Four days ago, Bitcoin’s hashrate plunged to 165 EH / s from the peak of 229 EH / s reached on January 2 due to the Internet shutdown in Kazakhstan as the government began to crack down on riots in the country.

The situation is improving now, and the hashrate is recovering.