Much like the general negative sentiment in the crypto markets, ETH got off to a rocky start in 2022, losing more than 20% in the first week of the new year.

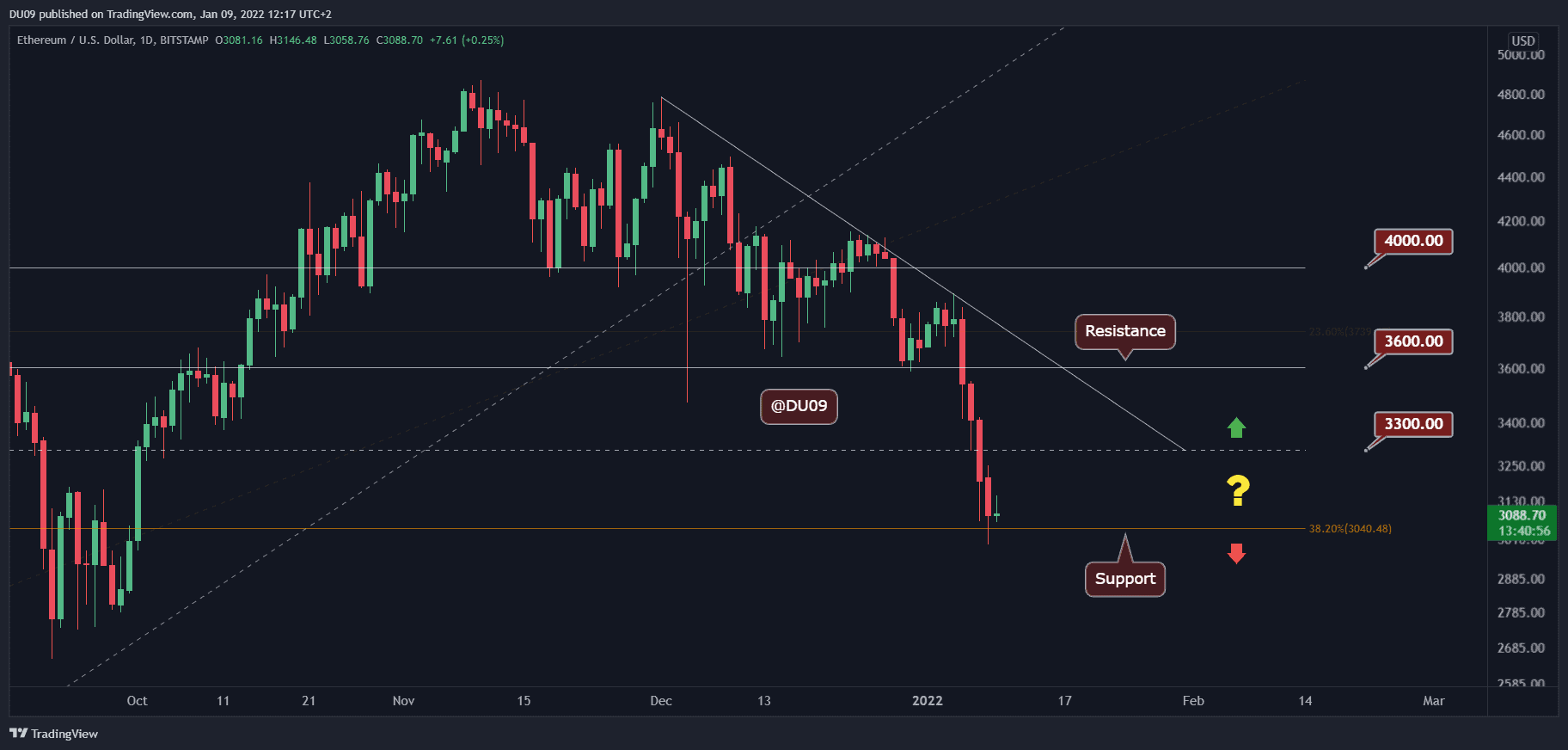

Key assistance levels: $ 3,000 – $ 2,750

Key resistance levels: $ 3,300 – $ 3,600

The past week saw a significant crypto crash where ETH went as low as $2,987 (Bitstamp) on Saturday before recovering above the $3K support level as of today.

Last Wednesday the market entered a massive sell off: ETH has seen four consecutive daily red candles so far, breaking through key support levels of $ 3,600 and $ 3,300. Now those critical levels have turned into resistance.

At the time of this writing, the price appears to have found a local bottom on top of the $3,000 psychological support, and ETH could see a temp correction towards the key resistance levels, pausing a bit the selloff momentum.

In the event of a $ 3,000 outage, the next major support to consider is the September low, around $ 2,750.

Technical Indicators

Trading Volume: The selloff volume peaked on Thursday, and since then, the volume has declined, particularly on Saturday. This allowed ETH to finally stop the downtrend Sunday at just above $3,000 (as of now). However, the weekend price action should be taken with a grain of salt since most traders are off, along with the global markets that also affect the overall sentiment.

RSI: Daily RSI has reached oversold territory and may curve in a rally of relief. This is not bullish yet, as it may be temporarily if pressure from sellers returns in the coming week.

MACD: The daily MACD is bearish, and the histogram shows some first signs of decrease in the selloff momentum. If this continues, ETH can attempt a pullback to the $3,300 resistance level.

Bias

The bias for ETH is bearish. Watch Monday’s price action as that will indicate what will happen next to ETH.

Short-Term Price Prediction for ETH

After a bloody week, ETH finally found some support on the $3,000 level. This level must be defended well by buyers; otherwise, it would spell disaster for the altcoin market. Confidence in support levels is low particularly when the price dropped below critical levels last week without any pullback.