As the market may enter another round of correction, Shiba Inu’s dominance wanes

Shiba Inu’s dominance among the 1,000 largest Ethereum wallets has dropped to a three-month low with only 5% dominance and $1.7 billion remaining on whale-tier wallets.

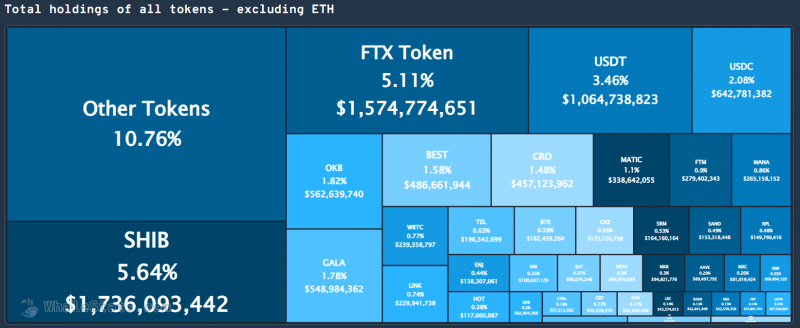

The dominance of assets in whales

Shiba Inu has always been one of the most dominant assets among whale skills, with its dominance reaching 12% by the point where SHIB reached its most recent ATH. Following the market correction, short-term traders and some whales began to sell their assets to avoid losses.

The next wave of buying power appeared after the most recent recovery of the token. Starting from Dec. 20, the asset’s price has faced a 25% increase in less than a week, but unfortunately for investors, it retraced by approximately 15% after.

Reasons for the dominance of the decline

The main reason for the decline in dominance is the distribution of funds in the market, with the majority of investors moving their funds to smaller altcoins or even stablecoins in order to preserve them during the cryptocurrency market correction.

According to the tracker’s data, the majority of funds currently remain in the “other tokens” category with 10% of all whales’ capital. The only token behind Shiba Inu is FTX token with $1.5 billion of whales’ funds sitting in the exchange’s utility token. The two categories following behind Shiba and FTX are the USDC and USDT tokens with a capitalization of $1.6 billion in all.

At time of publication, SHIB is trading at $ 0.000034 and is showing completely neutral price action after a 12% correction. In the past four days, the price of Shib has only changed by 2%.