In the final days of 2021, Bitcoin is struggling around the $ 50,000 price zone. The Main Cryptocurrency Is Facing A Huge Option Expiration Event On The Last Day Of 2021; therefore, the next few days should be volatile.

Option Market Analysis

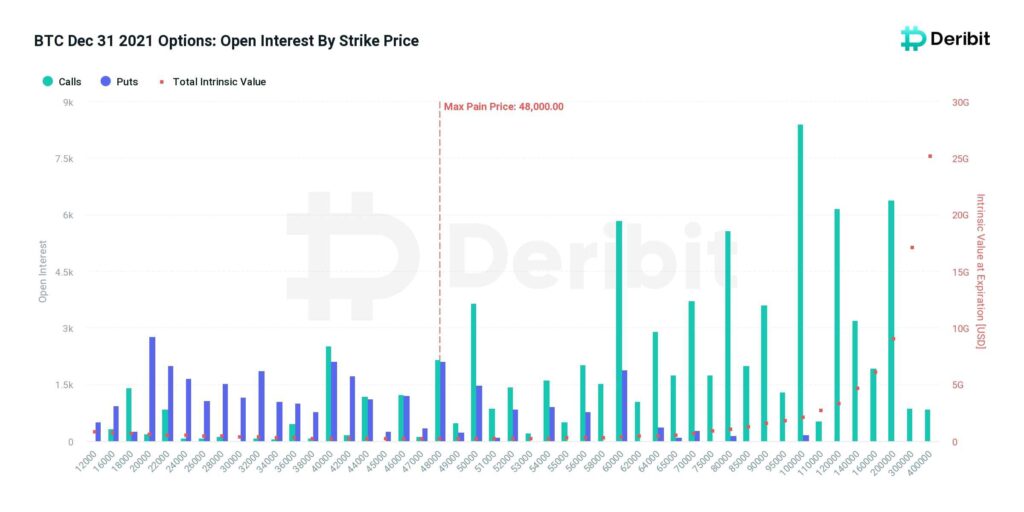

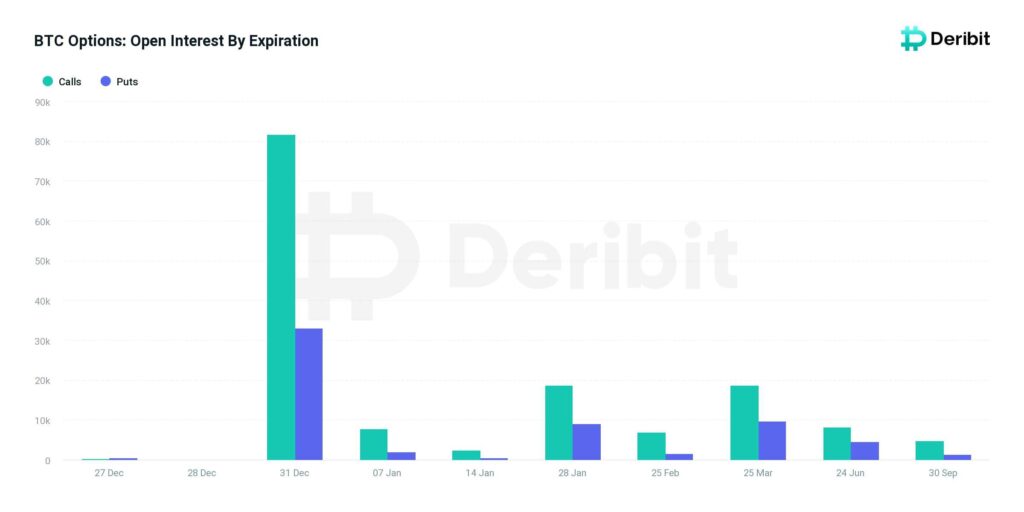

This Friday, 31st December, about $5.7 B worth of bitcoin’ options contracts will expire on Deribit Exchange.

The notional value of all expirations is approximately $ 10.7 billion. So, comparing to the notional value of 31 DEC, we can call it a massive expiration. The “max pain” price is $ 48,000. Additionally, sellers of calls for strike prices of $ 58,000 and $ 60,000 are not optimistic about a possible Santa Claus rally at the end of the year. Therefore, a high level of volatility is expected in the market in the coming days.

Technical analysis

Following the recent drop in ATH in November, bitcoin broke the MA-21 line by a 14% daily candle this week.

The Momentum indicator is above the zero-baseline, which could signify that the bulls are gradually stepping back into the market.

Short term technical analysis: the 1 hour chart

After its recent daily uptrend, the BTC price is again testing the most recent short-term support levels over the lower period.

After getting rejected by the MA200 line on the 4-hour timeframe, the price is expected to find support at the static zone (marked by green area), which has played an essential role since hitting $42K. Any drop towards the $48.7K – $49.5K levels (yellow circle) will be considered a healthy correction to gain the required momentum before continuing the price recovery.

Chain analysis

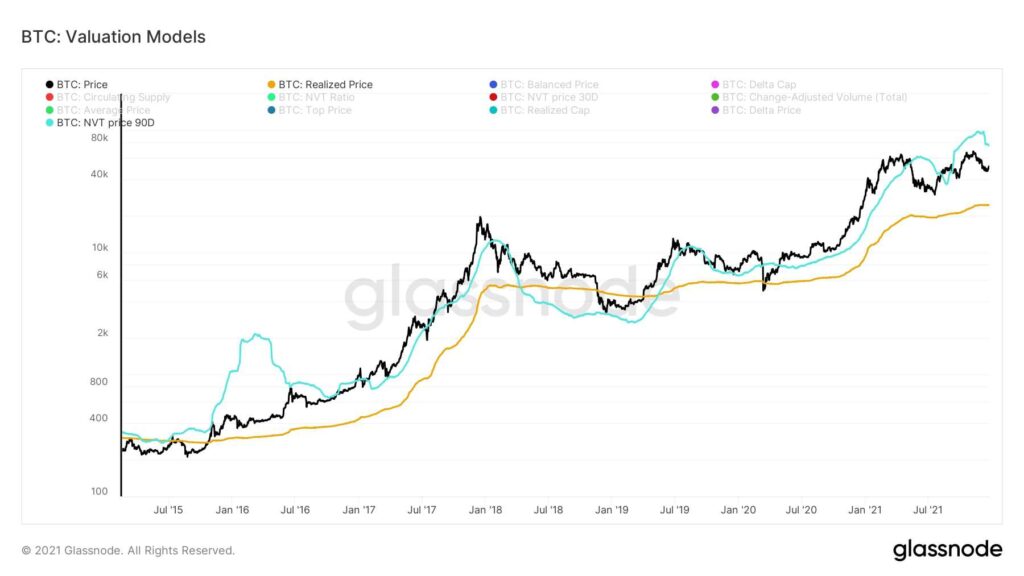

The NVT ratio values the Bitcoin network using the investor’s volume as it appears on the blockchain. The NVT ratio is the ratio of on-chain volume to its market cap, something like a PE ratio.

The NVT price level has been a useful BUY/SELL indicator for mid-term investors. Historically, whenever market price remained below the NVT price for an extended timeframe, later it had proven to be a great chance to accumulate more Bitcoin.