Ethereum is the king of altcoins and there is no doubt about it. Over the past week, certain on-chain metrics have moved in its favor and over the long-term, its price credentials promise higher returns. However, he is currently surrounded by an air of invincibility, which suggests that ETH could also avoid any short-term correction.

That is unlikely to be true, however. In this article, we will take a deeper look into the supply held by top addresses and how bearish diversions can be created, irrespective of supply changes.

Lower supply on exchanges doesn’t mean fewer chances of correction

According to Health, the ETH supply held on the stock exchanges fell to 15%. Last year, during the same time, the figure was around 23%. One can envision that the number of ETH entering smart contracts, DeFi protocols, cold wallets and staking addresses improves the stability of its market and decreases the selling pressure.

Now, technically, that makes complete sense since a lesser liquid market supply would mean demand will organically increase. However, that doesn’t really eliminate short-term bearish concerns.

How so? Well, because supply held on-chain remains high enough to create a divergence on the charts.

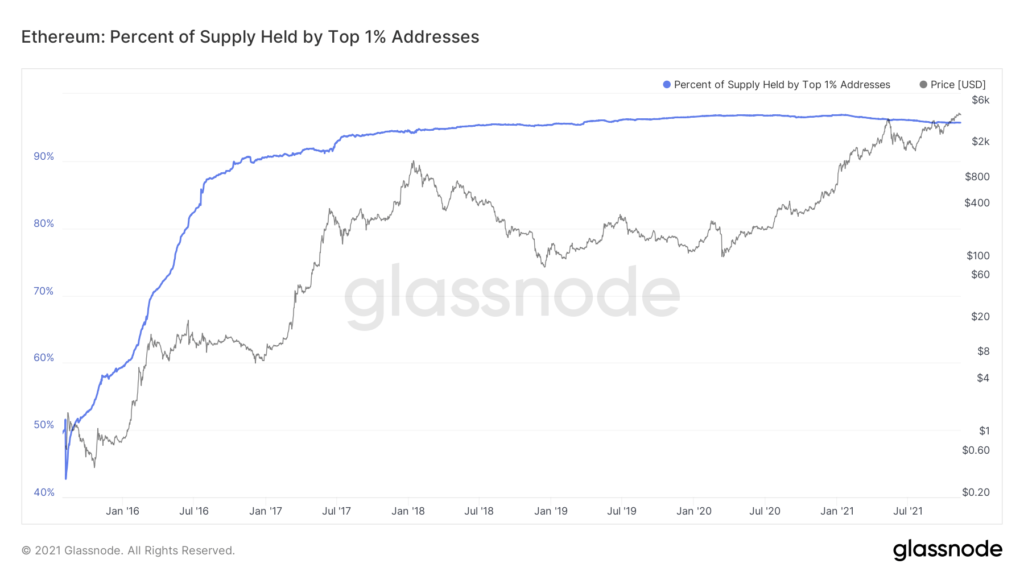

According to Glassnode, the percentage of the ETH offering held by the top 1% of addresses is close to 96%. It hasn’t gone down under 95% since February 2018 and indicates that a few thousand addresses hold a significant amount of Ether. Now, it is important to note that these addresses can belong to multiple individuals, entities or funds.

One particular address does not constitute a single person. However, the fact that some of the addresses can fuel a price change is also true. A group of investors might be sitting on tremendous profits, and a collective decision to take returns can still move the market.

Does this affect the decentralized nature of Ethereum? Technically, no.

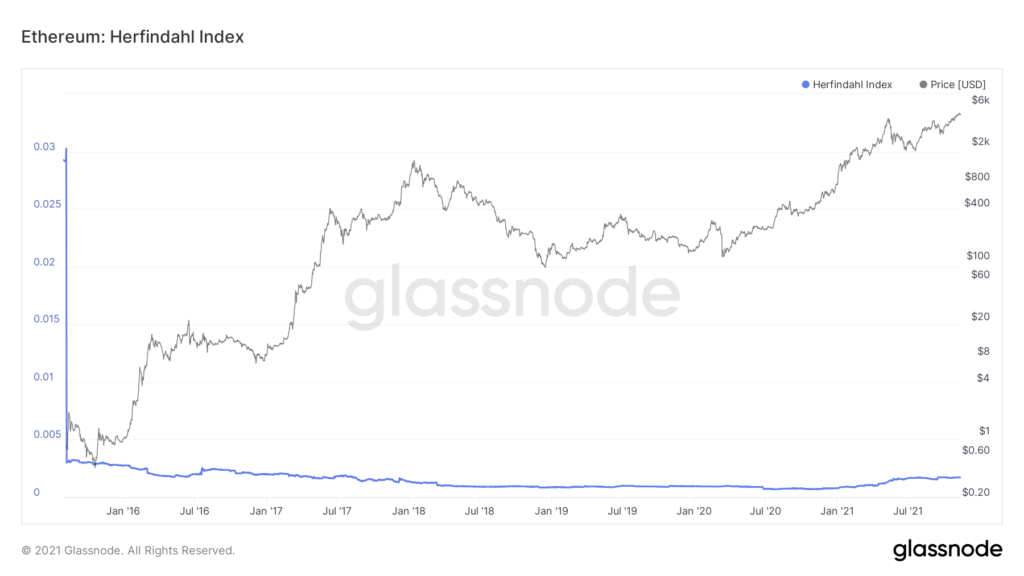

Ethereum’s Herfindahl Index has maintained lower levels since the beginning of January 2016. A lower Herfindahl Index suggests that ETH is more evenly distributed across addresses. Exchange addresses, smart contract addresses, and other special asset-specific addresses (e.g. team fund addresses) are excluded.

Stay on topic

The heart of the story remains the same. In the short term, the low supply of Ethereum held on the exchanges does not rule out the possibility of a correction as reversing the market structure and taking profit is an integral part of a volatile market.

It is absolutely necessary to invest in the market in accordance with risk adjustment since no digital asset is resistant to market sell-offs.