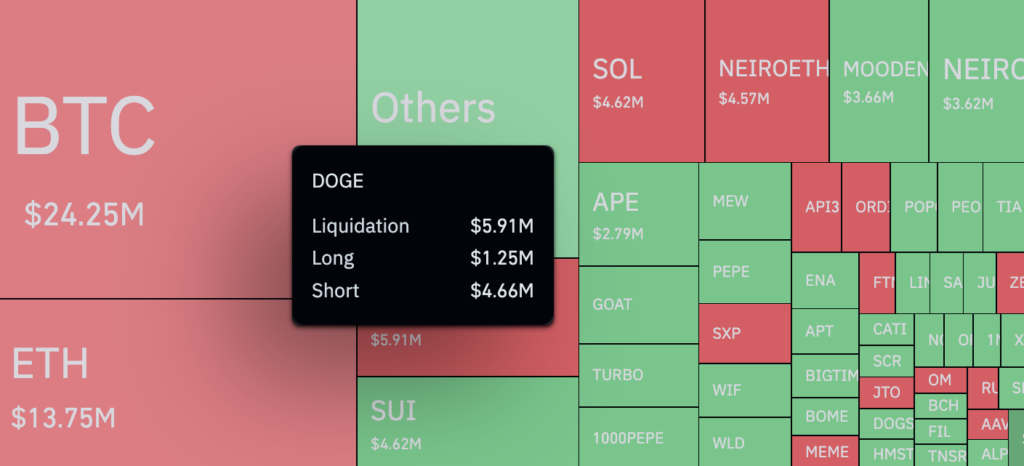

The volume of cryptocurrency position liquidations on the futures market over the past 24 hours has exceeded $111.44 million, as we discovered thanks to data from CoinGlass.

However, the imbalance of liquidations seen in the well-known meme cryptocurrency Dogecoin (DOGE) is more intriguing than the outstanding magnitude.

The total amount of DOGE liquidations over the reviewed period was $5.91 million. But of this, 4.66% is the liquidation of short bets, and $1.25 million is the liquidation of long positions.

As a result, we can say that the volume of liquidated positions held by bears who thought Dogecoin’s price to drop was about four times more than that of bulls.

Dogecoin (DOGE): Price outlook

It’s interesting to note that during last weekend’s bitcoin market collapse, many market players opened short positions because they thought the market would continue to decline, which ultimately resulted in such uneven dynamics.

Dogecoin, for instance, not only entirely recovered from Friday’s decline but also hit higher price levels on the strength of 15.62% rise. However, the truth was different.

Amidst all of this chaos, the liquidation arrangement reached an almost level keel, despite the fact that Friday’s decline seriously hindered bulls’ ambitions. We may claim that there is now uncertainty in the bitcoin industry.

With Dogecoin, on the other hand, the bulls have obviously dragged the rope to their side, thus this is not the case.