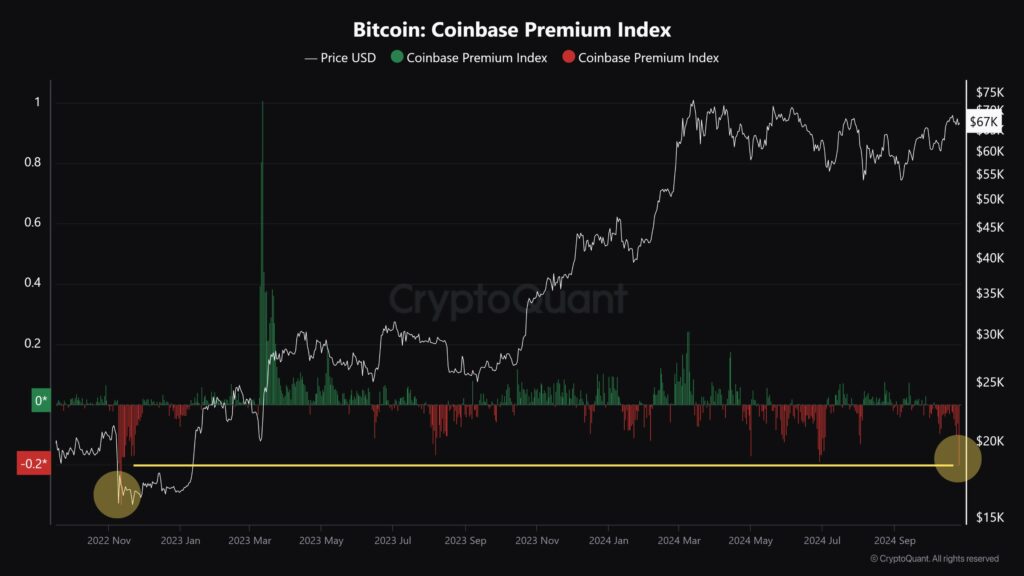

The Coinbase Premium Index, which gauges the price difference between Bitcoin on Coinbase and other exchanges, just dropped to -0.2%, the lowest level in two years. The premium indicator gauges the institutional interest that flows via Coinbase. As of right moment, the value of the signal points to a potential downturn in U.S.-based trading platforms like Coinbase.

It’s a popular assumption that U.S. purchasers are selling more often than buyers from other countries, which might indicate that institutional demand in the US is weaker. A positive Coinbase Premium in the past has signalled strong institutional purchasing power, which usually drives up the price of Bitcoin. A negative premium, on the other hand, can portend upcoming price instability or possibly a slump if the trend continues.

If substantial institutional interest in the commodity doesn’t reappear, this low premium would signal a pause in the upward trend of Bitcoin, which has seen a rebound in recent months. The important support level for Bitcoin, which is now trading around crucial levels, is $65,500, which emerged from the last decline channel.

A drop below this level would force Bitcoin to test the $63,000 zone, another significant support level based on recent trading behaviour, if selling pressure continues to increase. Positively, if buyers take control and the Coinbase Premium goes positive, Bitcoin may target $72,000, which many experts believe to be the next major barrier level.

Even though Bitcoin has shown durability around its current price levels, a reversal in the premium index would signal a return of institutional confidence. Traders should keep an eye on the $65,500 and $63,000 support levels for the time being, as a collapse there might signal further substantial declines.