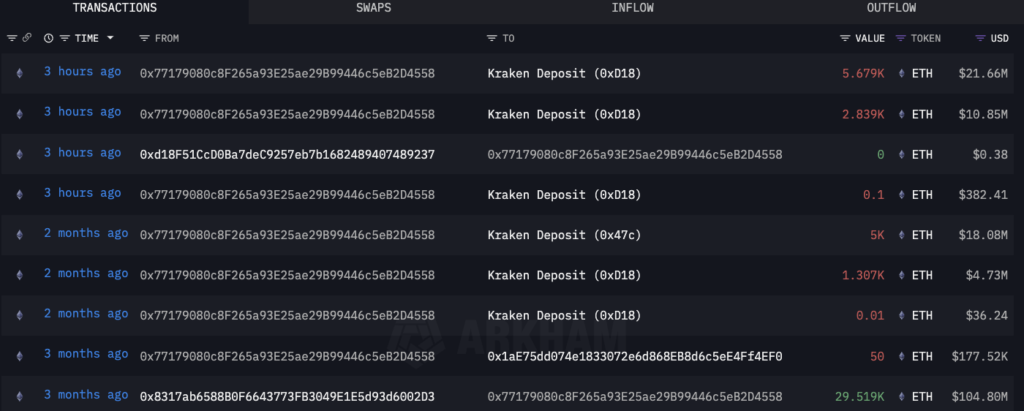

We have learned that 8,518 ETH, or $32.51 million, were sent by an anonymous Ethereum ICO participant to the address of Kraken, a significant American exchange. There were two installments to the transfer.

What is this whale’s known history? 14,644 ETH, or $55.91 million, are still held by their address, “0x771,”. When the primary cryptocurrency was worth $0.311 during the ICO, this unidentified big holder got 100,000 ETH at address “0xc348.”

He sold them over the course of a year following the July 2015 ICO. Then, barely three months ago, he unexpectedly stopped and started up again, moving 29,519 ETH to the address that is now in use. Since then, tokens have been sent twice to Kraken by the unidentified Ethereum address, the most recent of which was today.

This investor most likely made the decision to lock in a profit on his tokens. There has been a 1,228,387% increase in the primary altcoin’s price since the ICO. If the investor had not been selling his 100,000 ETH all along, he would have profited $349.7 million.

Whale behaviours like these have historically been seen as negative indications, which frequently cause the market to become more volatile. Nonetheless, Ethereum’s price has increased by 0.8% today, and it is now just 7% behind its peak. It will be fascinating to watch how things work out and whether or not this case encourages additional whales to get back on the market.