Recent data from CoinGlass indicates that there has been a significant market movement, with the trading volume of derivatives on the well-known cryptocurrency XRP rising by an astounding 93% in only the previous day.

The significant increase in perpetual futures turnover on XRP, which reached $661.08 million, highlights this spike. Simultaneously, the XRP spot market saw a 68% rise in trading volume, culminating in an astounding $800 million.

The combined effect of these activities has caused the total value of XRP turnover on centralised platforms to soar to $1.46 billion in only one day. With XRP’s market capitalization at $28.32 billion, the trading volume now amounts to about 5.1% of the company’s entire worth, indicating a substantial yet manageable degree of trading activity.

Bulls take L

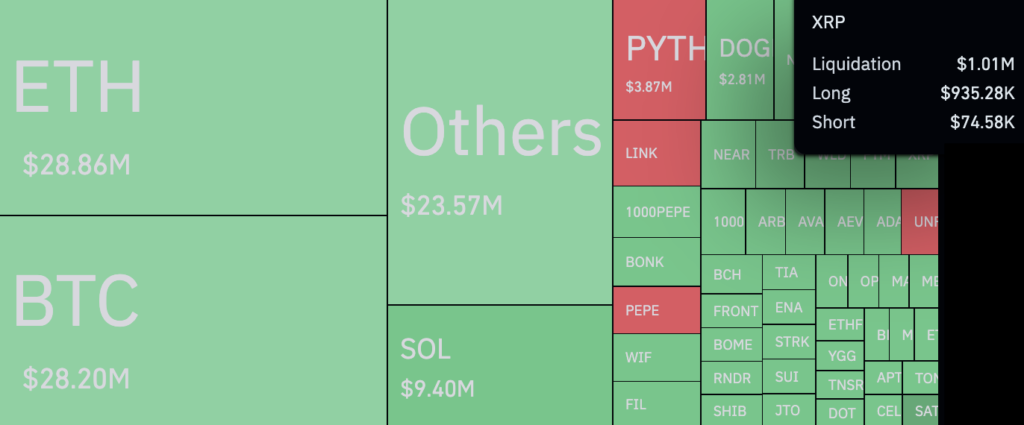

But along with the increase in trading activity, there has also been an extraordinary spike in long position liquidations. In sharp contrast to the negligible $74,580 liquidated from bearish positions, a whopping $935,280 million worth of bullish bets have been liquidated in the last day.

This startling 1,254% disparity is illustrative of the current state of the market.

Strong investor interest is shown by the increasing activity, but the large liquidations of bullish positions point to a painful correction for many traders.

The current price of XRP is about $0.50 per coin. According to the chart, since May 2023, the price of XRP has been quoted inside an upward corridor; the upper dynamic barrier is now at $0.80 per token. The market is extremely vigilant for any volatility as the token’s dynamic performance continues to draw attention.