The most well-known meme cryptocurrency, Dogecoin (DOGE), has seen concerning on-chain changes within the last day. IntoTheBlock data indicates that the Large Holders Inflow measure has decreased significantly by about 86%. This measure monitors the flow of money into the addresses of big investors, or “whales.”

The inflow of large holders decreased from 428.72 million DOGE to 62.63 million DOGE, or around $9.45 million. Such a decline suggests that these important stakeholders are not making as many purchases. A decline in this measure usually indicates a decline in buying activity since many big holders buy assets on centralised exchanges and then store them in cold storage.

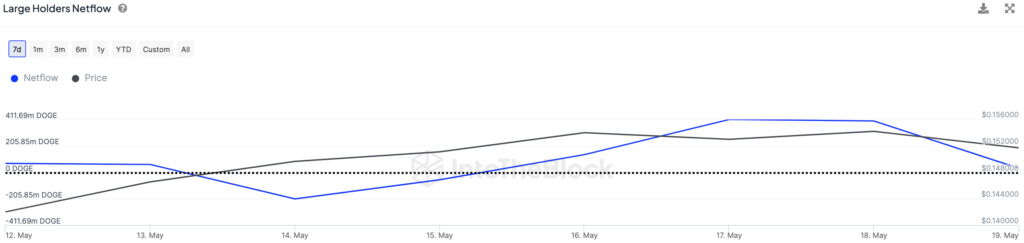

Furthermore, there has been a noticeable drop in Large Holders Netflow, which offers information on position movements of investors and whales owning more than 0.1% of the supply. It moved into the black last week at 411.69 million DOGE, but it has subsequently dropped to 31.71 million DOGE. This change in netflow might be an indication of reduced holdings or sales among major players, since it reflects a shift in mood.

What about Dogecoin (DOGE) price?

The price of Dogecoin has fluctuated during the course of the last day, losing 2.57% yesterday and another 1.46% today. The cryptocurrency is now trading at $0.152 per DOGE.

It is important to consider the effects of the decline in whale activity on the dynamics of Dogecoin pricing. Large holders’ activities have historically had a big influence on market movements. Consequently, the abrupt drop in whale activity may indicate a shift in institutional investors’ attitudes or raise market volatility.