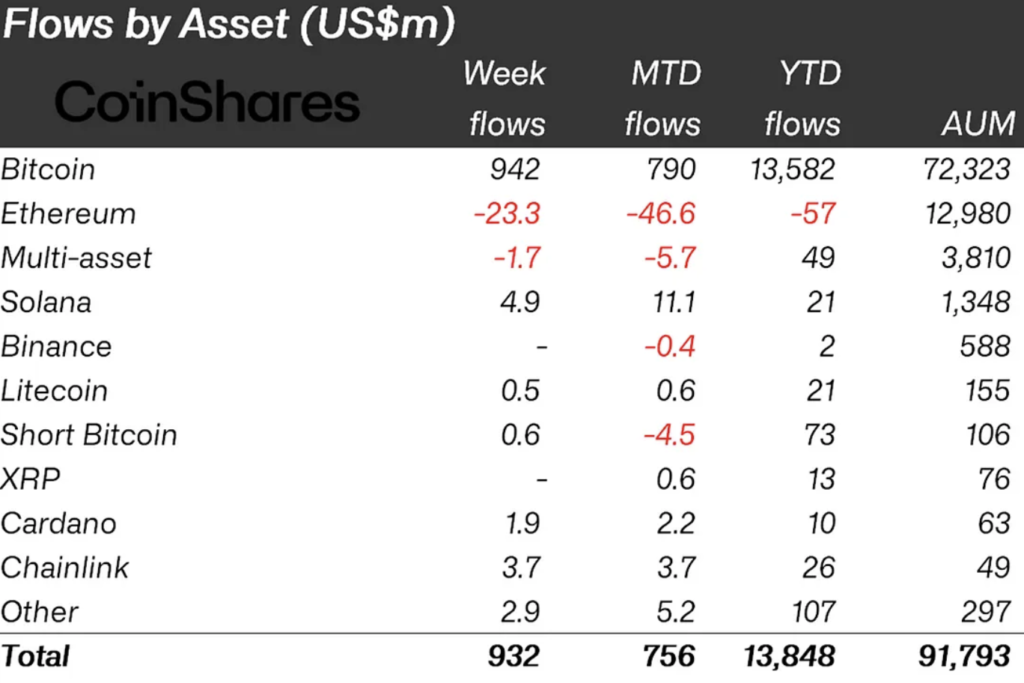

In CoinShares’ most recent weekly fund flow analysis, inflows into digital asset investment products increased significantly to $932 million. This is a 716% increase over the $130 million from the previous week.

The significant increase came after a CPI data that was lower than anticipated on Wednesday. The final three trading days of the week accounted for 89% of all inflows, suggesting that there is still a relationship between projected interest rates and cryptocurrency prices.

These inflows were mostly directed into Bitcoin (BTC), confirming its dominance of the cryptocurrency market. $942 million was invested in Bitcoin ETFs throughout the course of the week.

The lack of substantial interest in short Bitcoin holdings points to a promising future for investors. Since the start of the year, $13.85 billion has been invested in Bitcoin investment products.

Cardano soars into spotlight

A number of digital assets also experienced noteworthy inflows among cryptocurrencies. The three most notable inflows were $4.9 million, $3.7 million, and $1.9 million for Solana, Chainlink, and Cardano (ADA), respectively.

The fact that Cardano experienced no inflows the week before yet recorded about $2 million this week makes its inflows more noteworthy. As a result, $10 million has been invested in Cardano ETPs overall this year, indicating growing investor interest in this asset.

Ethereum, on the other side, had difficulties due to $23 million in withdrawals. Investor caution stems from this adverse mood, which is linked to uncertainty surrounding the SEC’s approval of a spot ETF.

It is safe to say that investor trust in Bitcoin and Cardano is building after significant inflows occurred last week.