As was made public, Solana (SOL) has had an extraordinary increase in fund inflows of 1,966% during the last week, solidifying its position as a prominent leader in alternative investment products with a focus on cryptocurrencies.

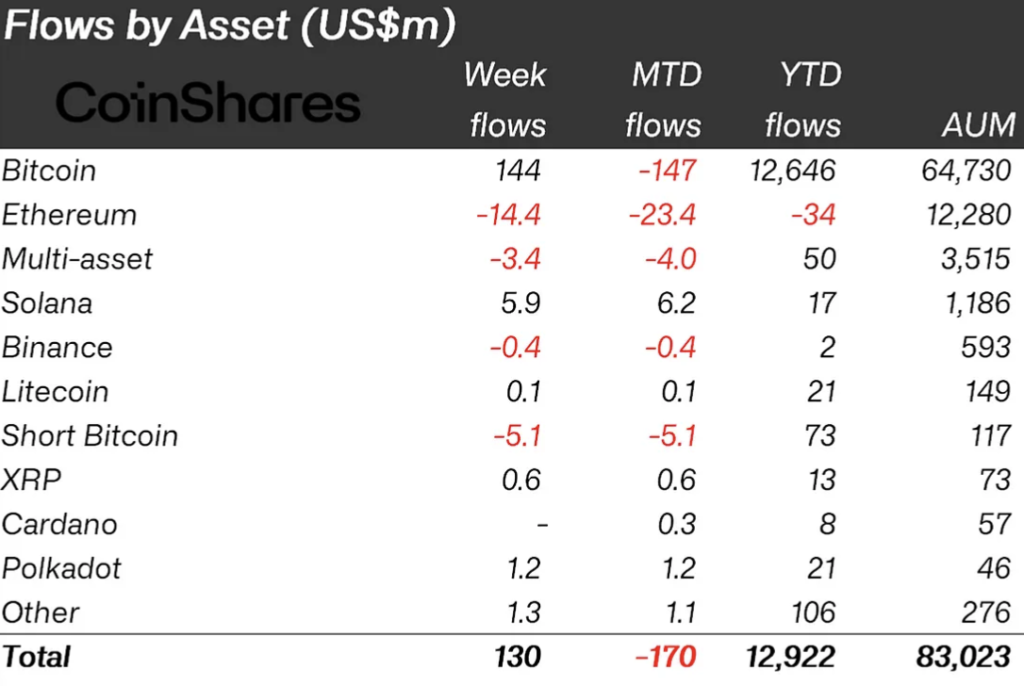

In this brief period, a significant $5.9 million was reportedly allocated to SOL-related items, according to the most recent data from CoinShares. This spike represents an almost twenty-fold increase in inflows into Solana ETPs, reaching an astonishing $17 million since the beginning of the year, and it also underlines SOL’s supremacy.

In contrast to this noteworthy upward trend in SOL, the overall state of the industry presents a different image. ETP volumes fell significantly from April’s $17 billion to $8 billion, despite investment products for digital assets seeing a promising $130 million influx.

This pattern indicates that ETP investors are becoming less active in the cryptocurrency space; they currently account for only 22% of all trade volume on reliable international exchanges.

When Solana ETF?

There is conjecture about the viability of a Solana ETF as regular investors’ interest in SOL grows. But the future of the Ethereum ETF has a big impact on the possibility of such an ETF. The regulatory roadblocks it faces make the route to a Solana ETF seem similarly difficult.

The Ethereum ETF status is notably unclear from a regulatory standpoint; this confusion was increased when the SEC classified SOL as an unregistered securities in the lawsuit against the Kraken exchange that took place last year.

The possibility of a Solana ETF is still uncertain as investors wait for clarification on the ETF front. It depends on regulatory changes and how Ethereum’s ETF predicament is resolved.