Recently, Cardano has found itself in a precarious situation where 2.5 billion ADA might be at danger as the price struggles to hold above a crucial support level. Since the beginning of the week, ADA has been under selling pressure, and its price is expected to record a fourth straight day of losses.

Due to the decreases, ADA has reached a critical price level, where a sizable portion of Cardano addresses own 2.5 billion ADA.

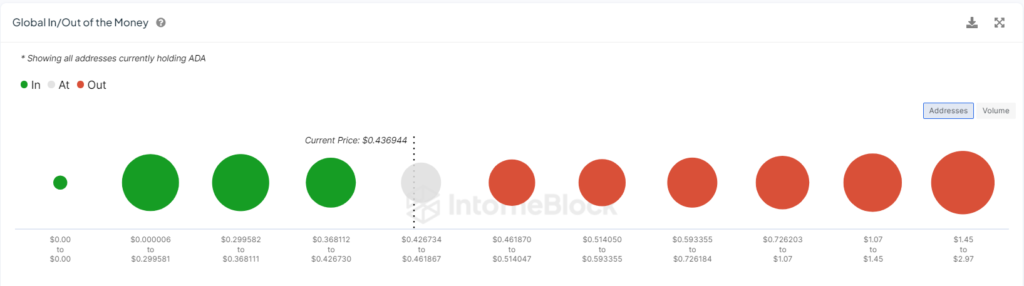

IntoTheBlock data shows that 212,010 addresses purchased 2.51 billion ADA at an average price of $0.447 between $0.426 and $0.461.

At $0.426, ADA is now trading down 0.38% over the past day to $0.432, putting it dangerously near to the lower end of this range.

This unstable situation might lead to a decline in the value of the 2.5 billion ADA coins that a large number of investors now own if the price falls below this critical level.

A decline below this critical zone might perhaps lead to a challenge of the $0.40 support level. Investors may find chances to purchase in such a shift, but holders of the 2.5 billion ADA would be exposed to danger.

The price of ADA may be affected by how the bulls and bears fight out in the end. On-chain data indicates that ADA may reach its next resistance area between $0.46 and $0.51 with a persistent advance above this important price range.

From a technical perspective, the first indication of strength for ADA bulls might be a consistent breach above the daily moving average.

In a larger sense, as investors wait for the Fed to decide on interest rates, the cryptocurrency market is seeing a sell-off. Although no adjustments to interest rates are anticipated from the Federal Open Market Committee (FOMC), investors are growing more worried that the central bank may decide not to lower rates this year, which would be devastating for interest rate-sensitive assets like cryptocurrencies.