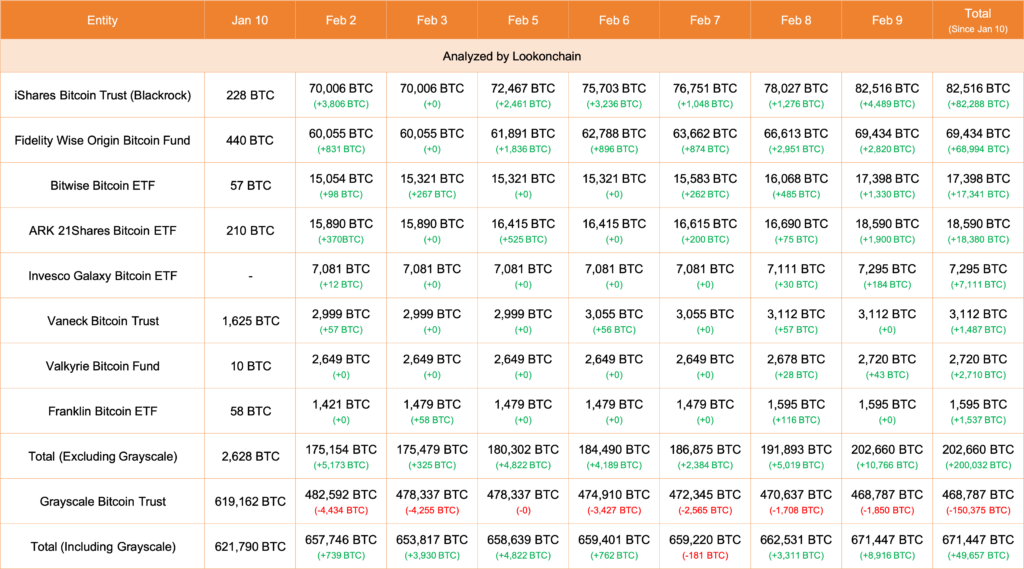

A $500 million inflow has been seen in Bitcoin ETFs today amid a notable upswing in investing activity. According to Lookonchain’s most recent report, eight Bitcoin ETFs have amassed 10,766 BTC, or an astounding $510.6 million. This inflow coincides with a significant drop in Grayscale’s holdings, which saw a loss of 1,850 BTC, or $87.7 million.

One of the main drivers of this increase was IBIT, the BlackRock-managed iShares Bitcoin Trust, which received a substantial infusion of $4,489 BTC, or $212.9 million. Fidelity followed suit and added a substantial 2,820 BTC, or $133.7 million.

The report emphasises further more how iShares Bitcoin Trust, which now has a dominant 82,516 Bitcoin, dominates the ETF market. The Bitwise Bitcoin ETF completes the top three with holdings of 17,398 BTC, while Fidelity’s Wise Origin Bitcoin Fund lags behind with 69,434 BTC. When taken as a whole, including Grayscale, Bitcoin ETFs are presently valued at an astounding $31.76 billion, or 671,447 Bitcoin.

Institutions want more Bitcoin

The chief investment officer of BlackRock has hinted at a possible increase in the company’s exposure to Bitcoin, and these developments coincide with a wider shift in mood among the finance community. In an interview with Wall Street Journal, he highlighted how perceptions of cryptocurrencies are changing and hinted at a rising degree of ease with their incorporation into frameworks for asset allocation.

Concurrently, the performance of the Bitcoin market reflects this increased investor interest; prices have risen by more than 5.7% today, hitting local highs of $47,650.

The combination of an increase in institutional investment and a positive outlook on the market highlights the increasing acceptability of Bitcoin among the general public and solidifies its position as a powerful asset class in the global financial system.