The first month of 2024 saw massive changes in the cryptocurrency industry, especially with regard to Bitcoin. Unquestionably, the momentous announcement made by the biggest hedge funds and financial organisations globally, which launched the age of spot Bitcoin ETFs, was the high point of January.

Bitcoin experienced a wild journey as a result of these events; in just 28 days, its price fluctuated between $48,969 and $38,555. But as January draws to an end, the leading cryptocurrency has made a strong comeback, ending the month with a little gain of 0.7% and almost going back to where it began.

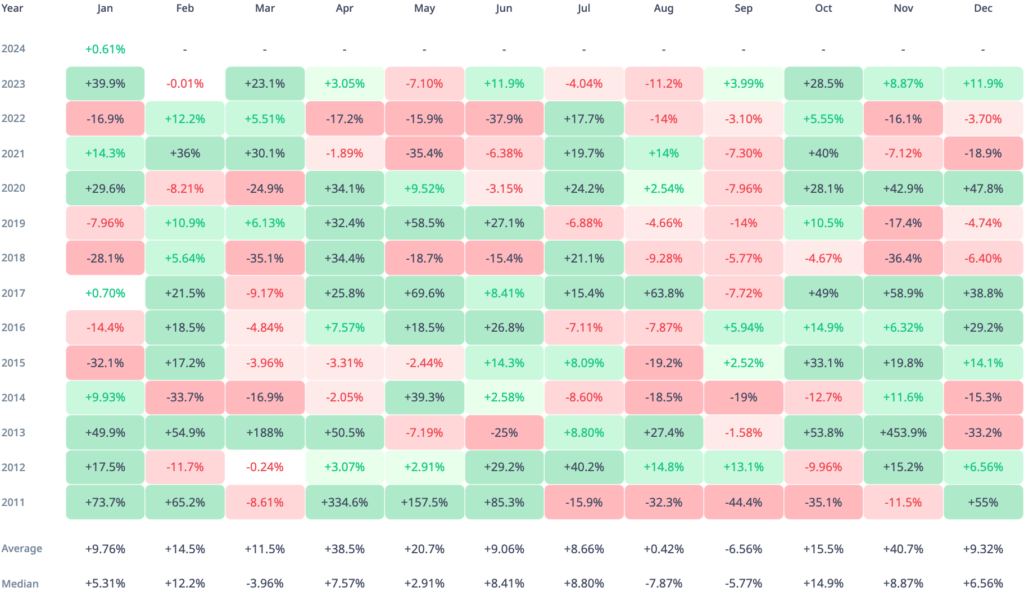

All eyes are on the historical data of Bitcoin prices as we enter February, and the patterns point to an interesting trend. Based on CryptoRank data from February of 2011 through 2023, Bitcoin has demonstrated a remarkable 14.5% average profitability rate, with the median value trailing closely at 12.2%.

The fact that the last time the price of Bitcoin had a negative February was in 2020, a memory ingrained in the memories of those deeply involved in the cryptocurrency market during that turbulent period, emphasises the significance of this month even more. The cryptocurrency saw a decline in February 2014 before that.

Examining the price history of Bitcoin shows a regular trend of increased activity and, most of the time, significant price fluctuations in February. Although the cryptocurrency market is dynamic and subject to constant change, the long history of Bitcoin as an exchange-traded asset dating back more than 10 years offers important lessons and direction.