Shiba Inu’s (SHIB) on-chain metrics indicate that there are still challenges to be faced in spite of the meme coin’s massive efforts to resume its upward trajectory. SHIB address profitability is estimated to be 24.37% by data from the cryptocurrency analytics tool IntoTheBlock (ITB), with 323,540 addresses now in the money.

When the 928,370, or 69.93% of less profitable locations are included, the data becomes alarming. A total of 347,430 addresses obtained 240.59 trillion SHIB at $0.000011, according to on-chain statistics. When the meme currency surges towards that price target, these addresses may decide to sell their SHIB holdings, creating a significant resistance point.

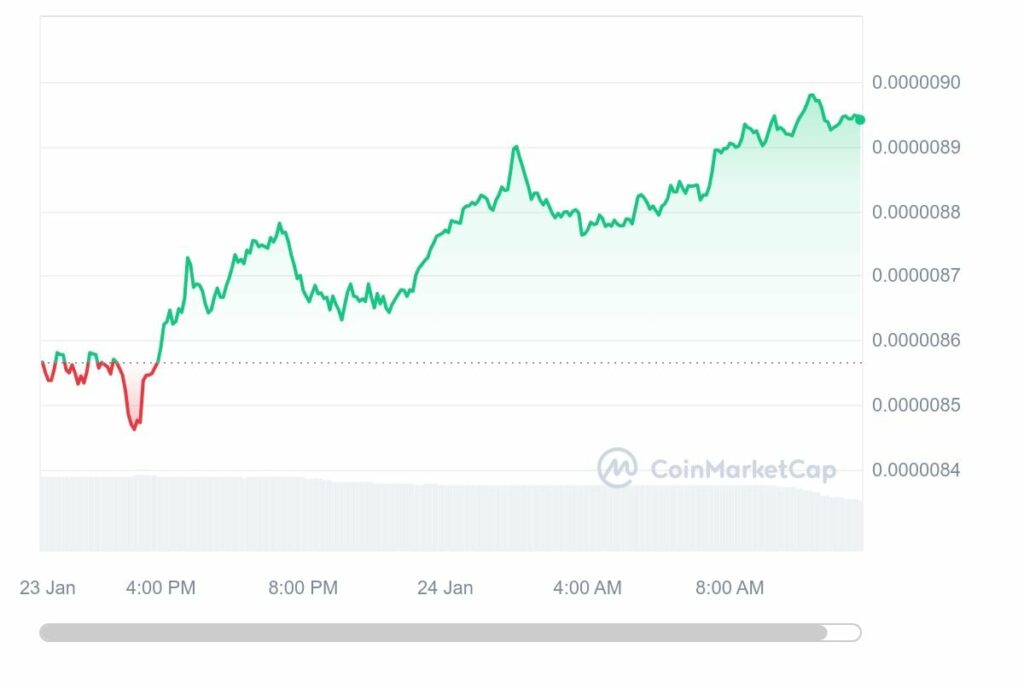

Since the beginning of the year, Shiba Inu has been under intense selling pressure as the token’s price has frequently increased and decreased by one zero, illustrating the never-ending battle between bulls and bears in the market.

Outlook on SHIB price

Shiba Inu is currently trading at $0.000008955, up 4.55% over the last 24 hours—the first sign of a rise in almost a week. Shiba Inu’s price hasn’t yet recovered the $0.000009 price level, despite this optimistic rise, suggesting that more adverse sentiment is still there in the market.

Shiba Inu’s road to recovery could be more difficult in the future since, as is fascinating, the digital currency’s stats are not getting better. For example, the Shiba Inu burn rate dropped by nearly 94% over night, with only a few million tokens going to inactive wallets.

The whale transaction volume and daily active addresses are declining, according to data from IntoTheBlock, which raises even more doubts about the token’s ability to overcome the obstacle it is now experiencing.