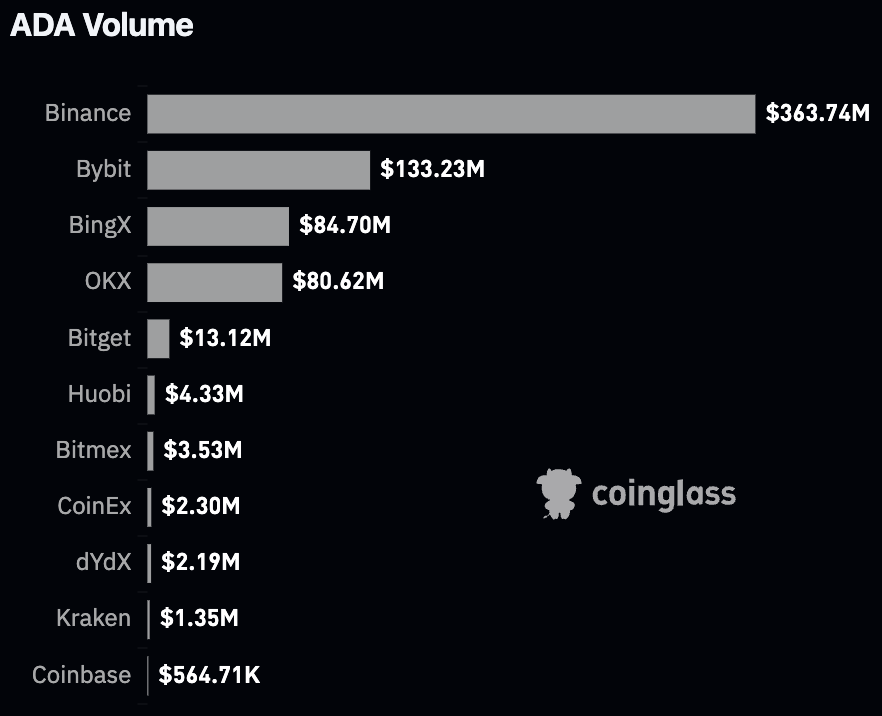

According to Coinglass, there has been a notable change in market dynamics as a result of the startling 80% increase in derivatives trading activity for Cardano’s ADA coin during the last 24 hours. The information indicates a significant rise in open-ended futures trading activity on ADA, amounting to around $700 million within the given time frame.

Adding spot market trades to the mix, the total trading volume of Cardano’s token has surpassed $1 billion in only the past day.

A normative level of involvement is shown by the rise in trading activity, which accounts for 6.25% of Cardano’s overall market capitalization. Cardano is still a major participant in the cryptocurrency industry, according to CoinMarketCap, with a market value of $16.16 billion, placing it as the eighth largest digital asset at the moment.

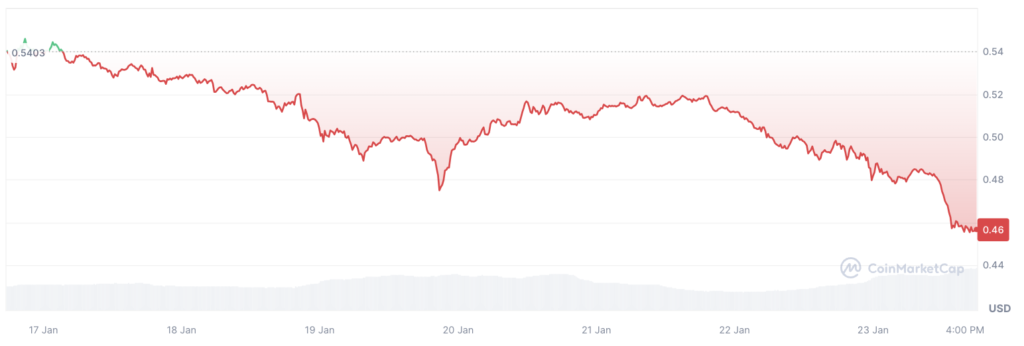

ADA, on the other hand, saw a significant 9.5% decline in the last day amidst the spike in trade activity, and it now stands at $0.4521, its lowest level since December. For Cardano, this area has historically functioned as a bottom, as seen by several instances of recovery following protracted declines, most notably in the spring and summer of 2022.

Remarkably, long holdings accounted for 95.24% of the liquidations that occurred in ADA transactions over the last day. This implies that even if a lot of optimistic traders are expecting ADA’s price to bottom out, their expectations are being dampened by their heightened risk appetite and the volatility of the cryptocurrency market.